Hi, Readers.

Minor update 21.3 for Business Central 2022 release wave 2 has been released last week. Learn more: Link.

Some new features are also available with this minor update. I will continue to test and share these features that I hope will be helpful.

The following information is mentioned in the What’s new and planned for update 21.3 for Microsoft Dynamics 365 Business Central online 2022 release wave 2.

| Country | Feature | Description |

|---|---|---|

| W1 | Changing VAT date with more entries for one document | When users have more VAT Entries for one document with different VAT percentages, and they want to change VAT date, they need to do only on one entry and the system will update to the other entries for the same document. |

| W1 | Disabling VAT date functionality fully or partially | Users now can choose to use full VAT date functionality or just partially without changing VAT dates in posted entries and documents. And eventually, users can choose not to use VAT date functionality, hiding and making noneditable VAT fields from UI. |

The VAT Date function is one of the new functions of Business Central 2022 wave 2 (BC21). We have briefly discussed it before.

More details:

New VAT Date field on documents and entries

Business value:

Users can report VAT statements and returns based on the new VAT Date instead of the Posting Date to meet requirements by certain countries.

https://docs.microsoft.com/en-us/dynamics365-release-plan/2022wave2/smb/dynamics365-business-central/new-vat-date-field-documents-entries

In this month’s minor update, Microsoft has brought us two small updates.

1. Changing VAT date with more entries for one document

When users have more VAT Entries for one document with different VAT percentages, and they want to change VAT date, they need to do only on one entry and the system will update to the other entries for the same document.

For example,

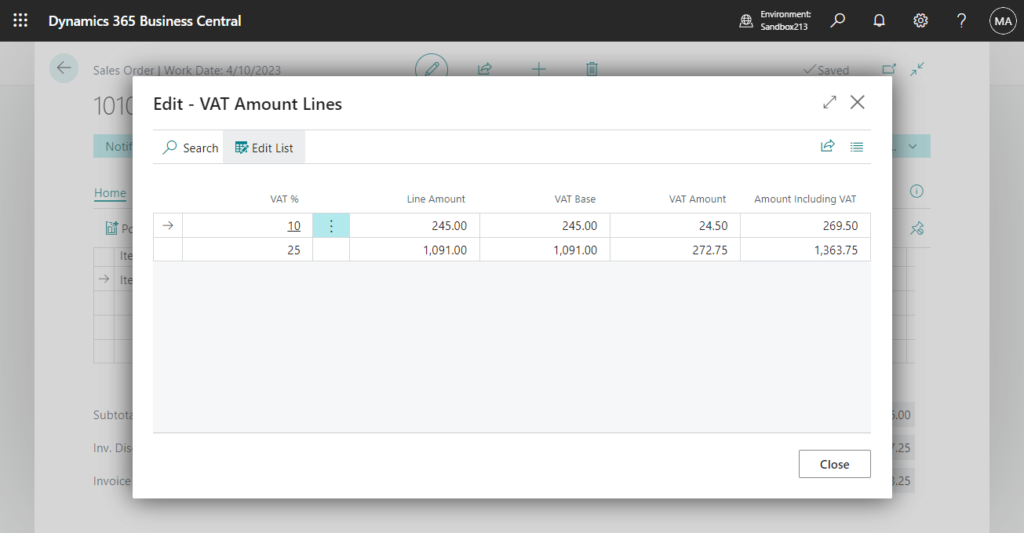

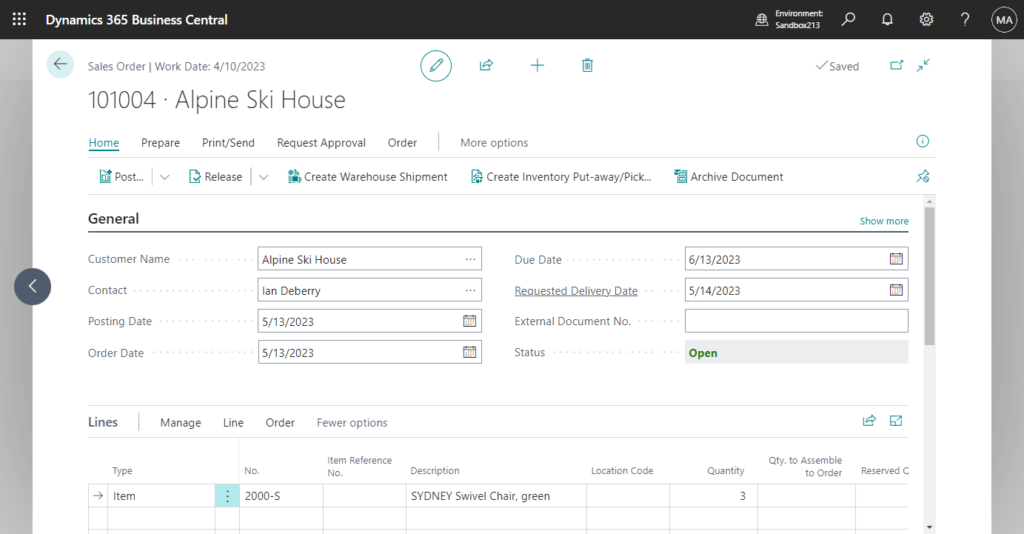

For example, I create a sales order that contains two different VAT percentages.

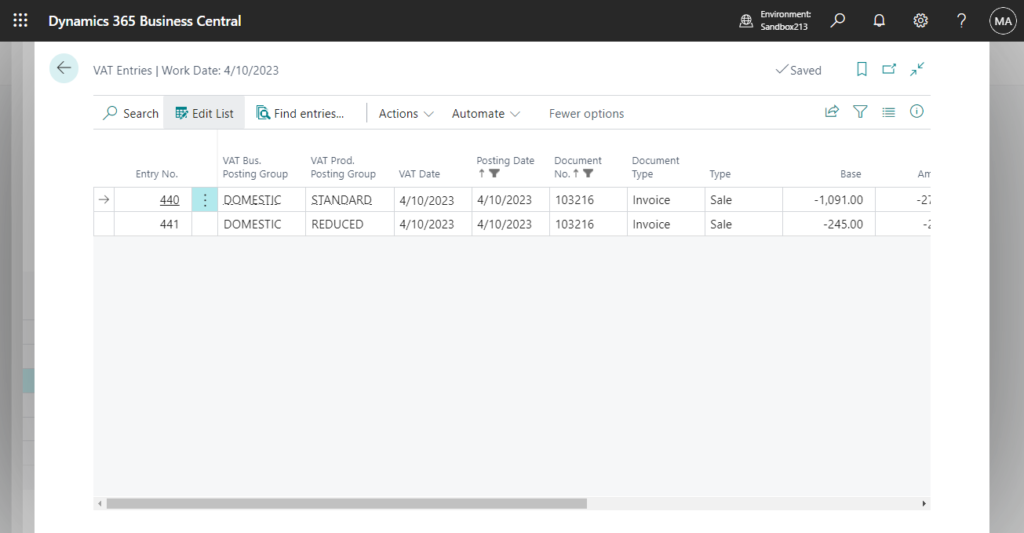

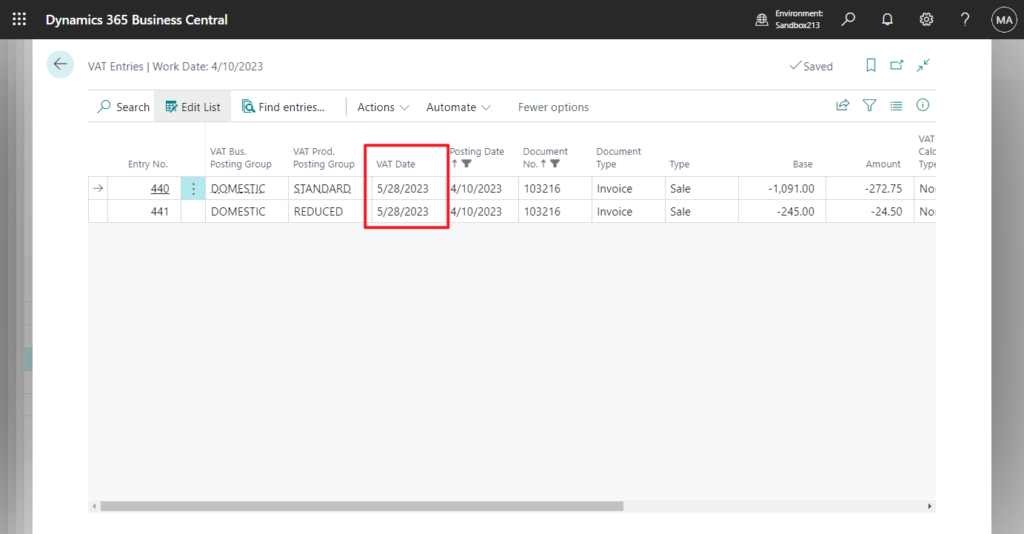

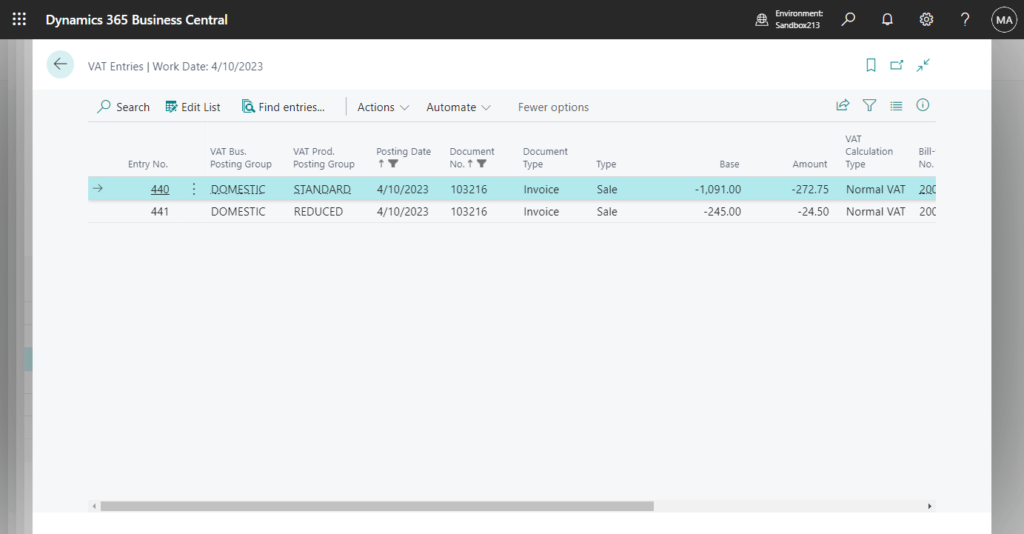

This will generate two VAT Entries.

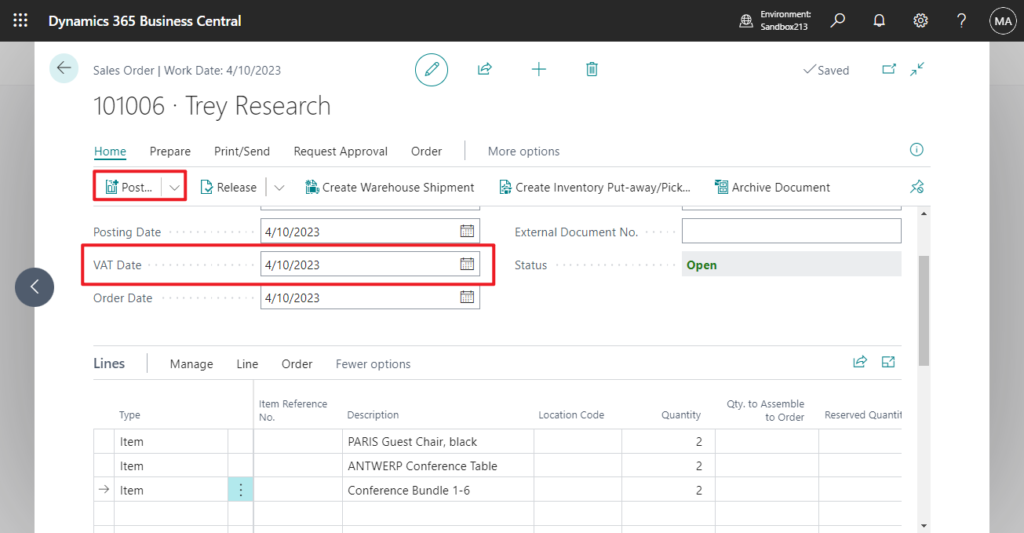

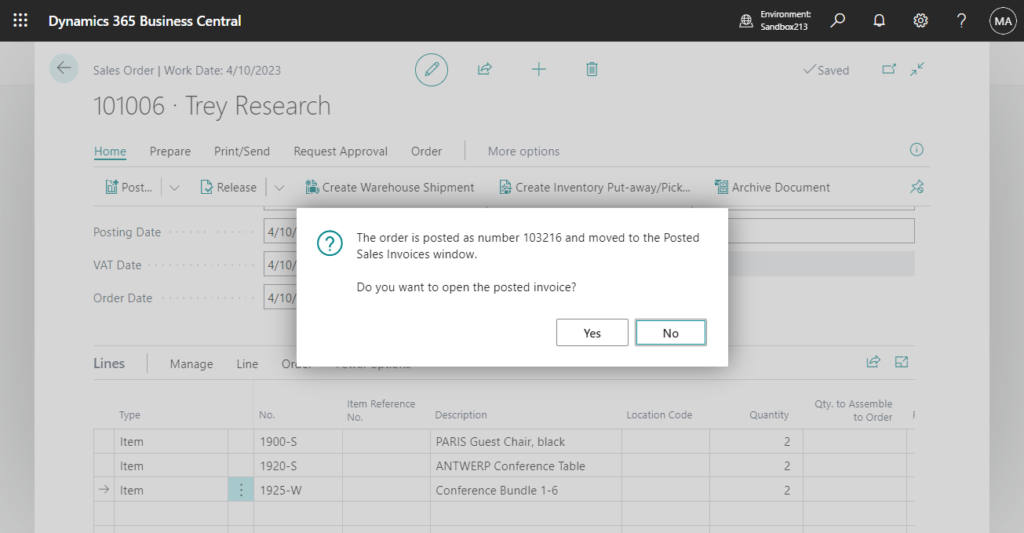

Post the sales order.

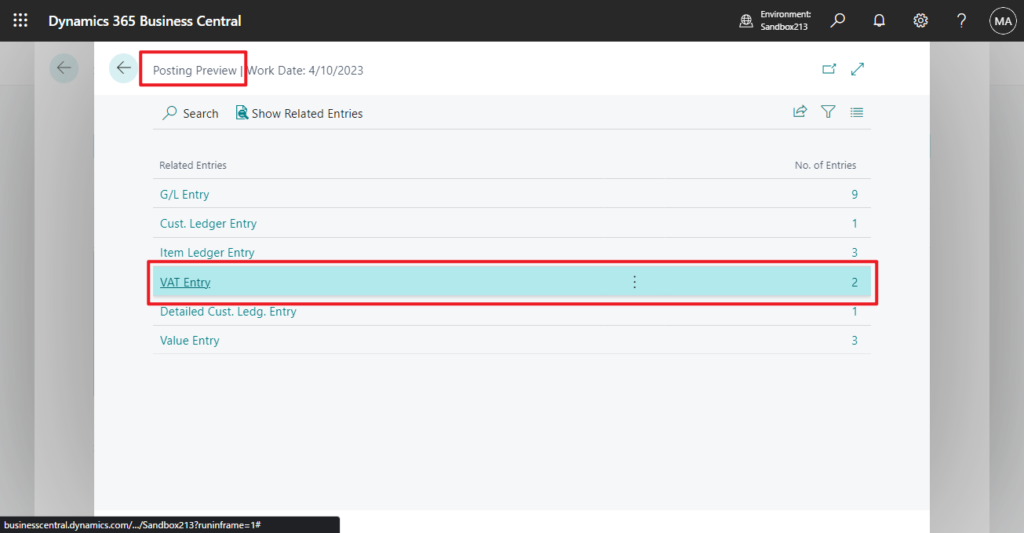

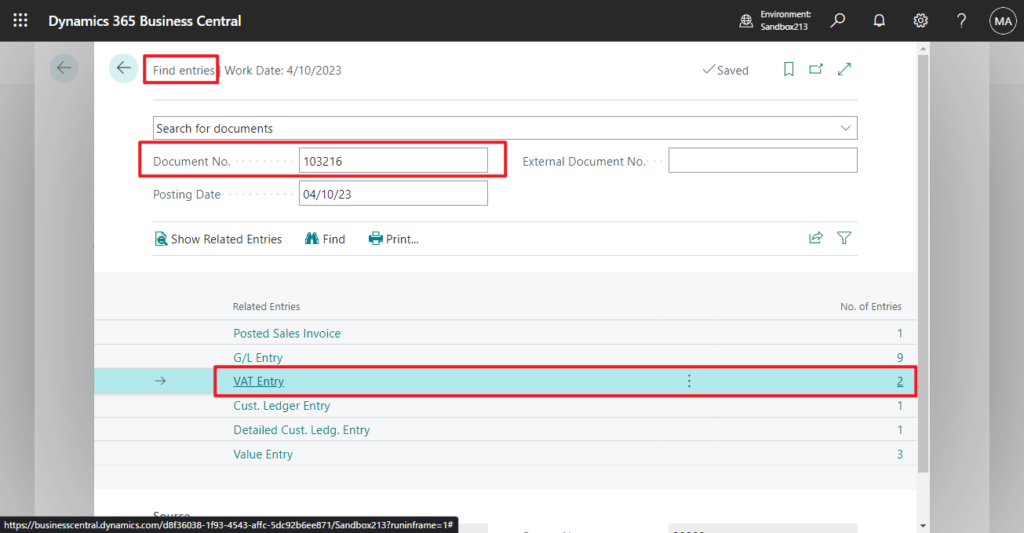

Find the VAT Entries.

In Edit List mode, when the user changes the VAT Date of one entry, the system will update to the other entries for the same document.

Test video:

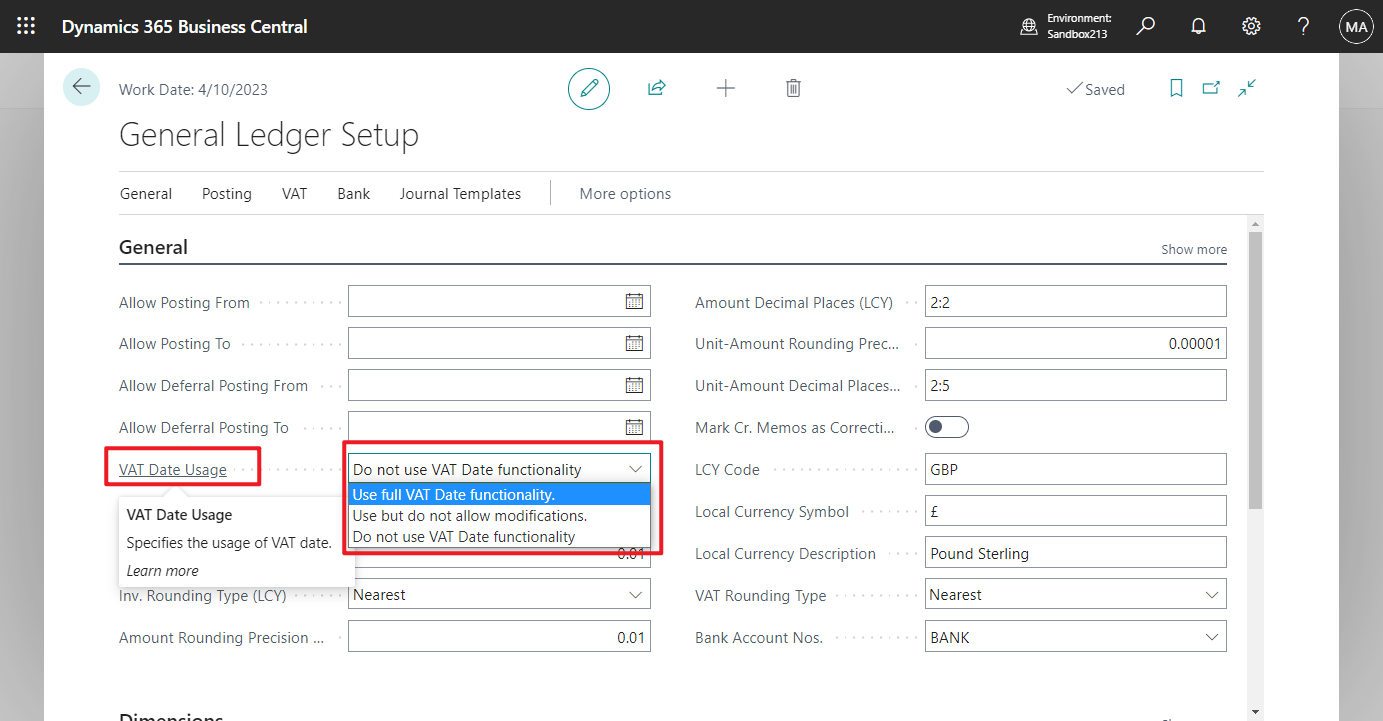

2. Disabling VAT date functionality fully or partially

Users now can choose to use full VAT date functionality or just partially without changing VAT dates in posted entries and documents. And eventually, users can choose not to use VAT date functionality, hiding and making noneditable VAT fields from UI.

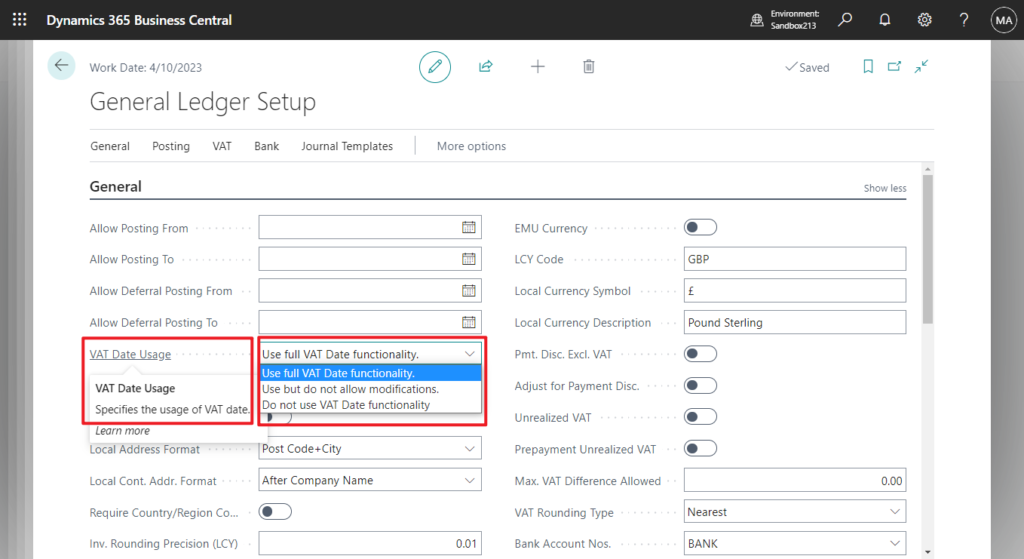

This new setting is added to General Ledger Setup page.

VAT Date Usage

Specifies the usage of VAT date.

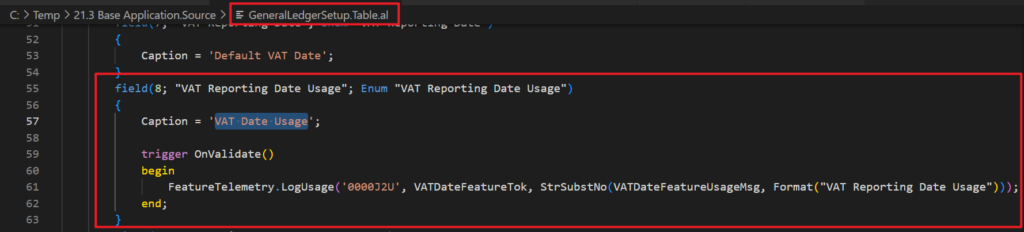

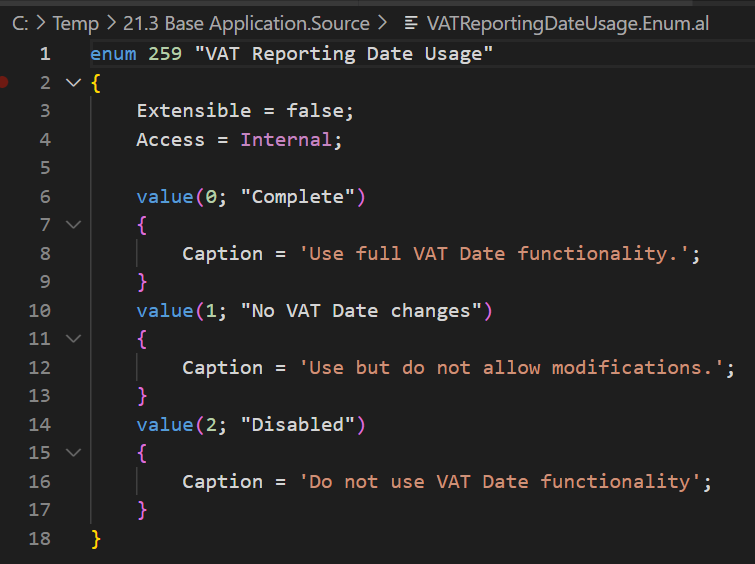

Standard Souce Code:

(Why do the first two have periods? But the third one doesn’t.?😑)

Use full VAT Date functionality: This is the default setting, the VAT Date is displayed on the page and can be changed after posting.

Use but do not allow modifications: The VAT Date is displayed on the page, but the user cannot change it.

Do not use VAT Date functionality: VAT Date is hidden in all pages, which is equivalent to turning off this feature.

For example,

In Sales Order:

In VAT Entries:

Give it a try!!!😁

END

Hope this will help.

Thanks for reading.

ZHU

コメント