Hi, Readers.

The preview environment for Dynamics 365 Business Central 2022 release wave 1 (BC20) is available. Learn more: Link

I will continue to test and share some new features that I hope will be helpful.

More control over deferrals posting:

Business value:

People use deferrals to recognize a revenue or an expense during a period that is different from the one in which the transaction was actually posted. Most accounting controls are focused on the current accounting period. The deferrals functionality lets you automatically defer revenues and expenses over a specified schedule and multiple accounting periods, giving accountants more control over when people post deferrals.

https://docs.microsoft.com/en-us/dynamics365-release-plan/2022wave1/smb/dynamics365-business-central/more-control-over-deferrals-posting

To recognize a revenue or an expense in a period other than the period in which the transaction was posted, you can use functionality to automatically defer revenues and expenses over a specified schedule.

To distribute revenues or expenses on the involved accounting periods, you set up a deferral template for the resource, item, or G/L account that the revenue or expense will be posted for. When you post the related sales or purchase document, the revenue or expense are deferred to the involved accounting periods, according to a deferral schedule that is governed by settings in the deferral template and the posting date.

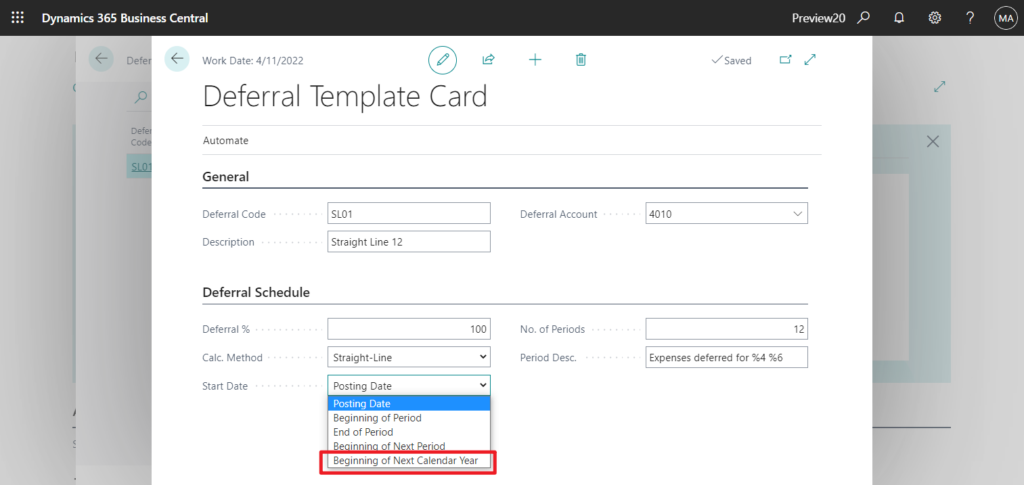

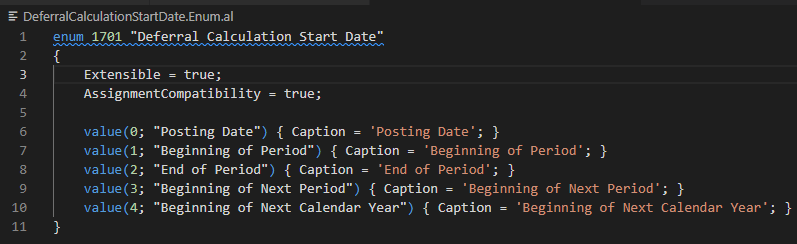

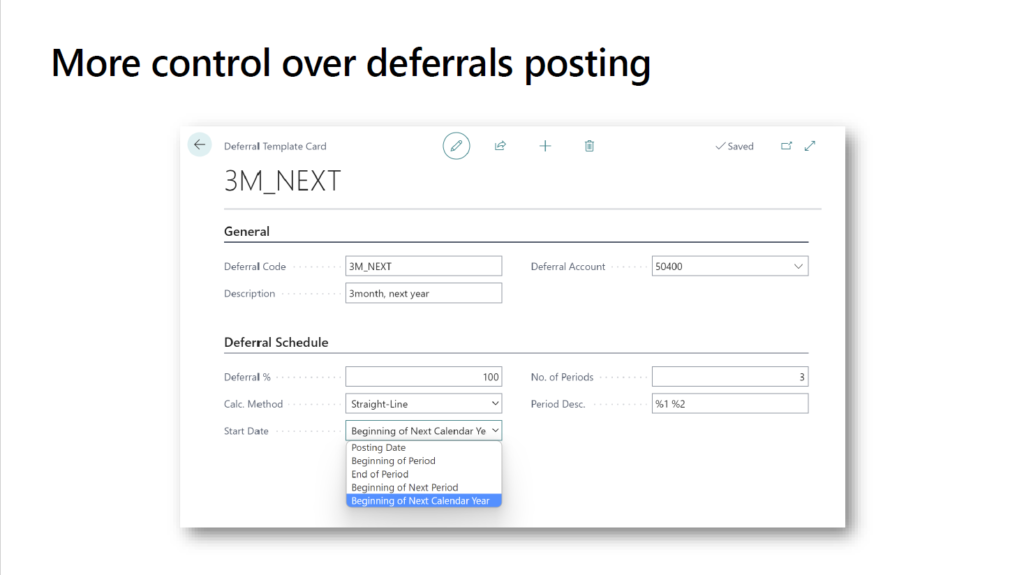

For deferral templates, you now have an option to specify Beginning of Next Calendar Year as the starting date.

PS: In BC19.5

Source code:

Let’s see more details.

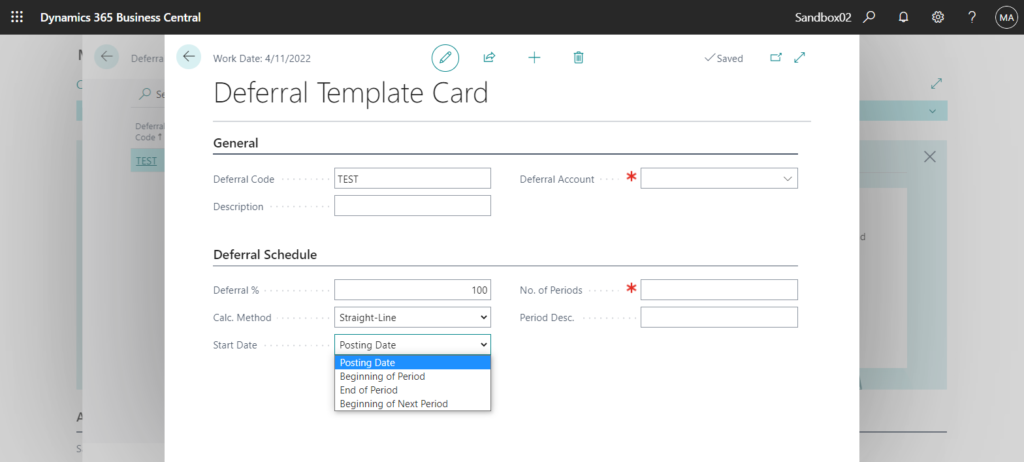

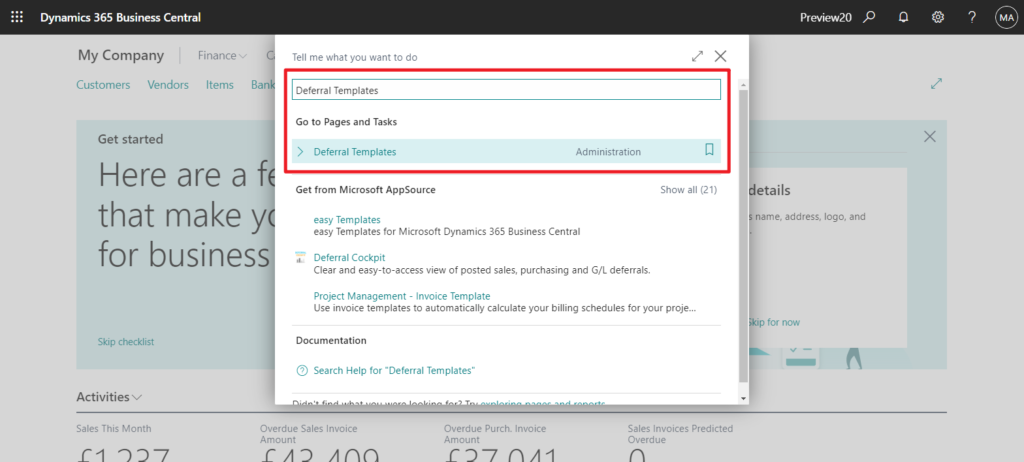

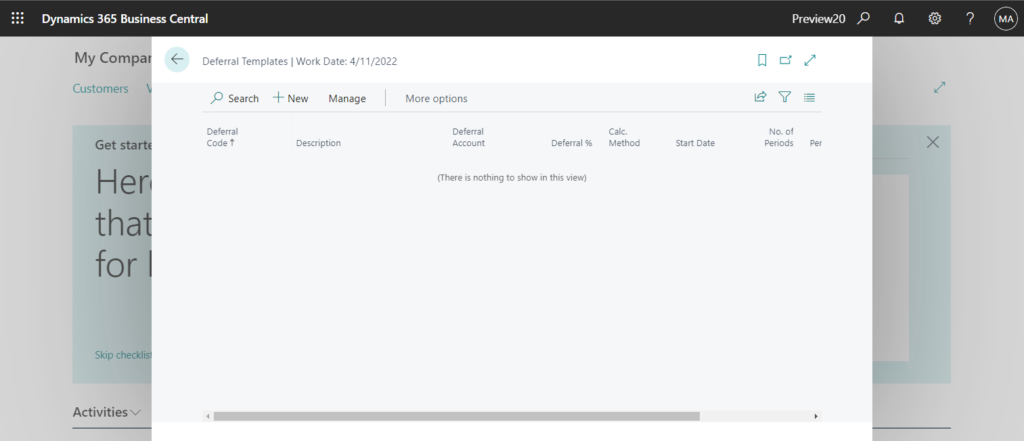

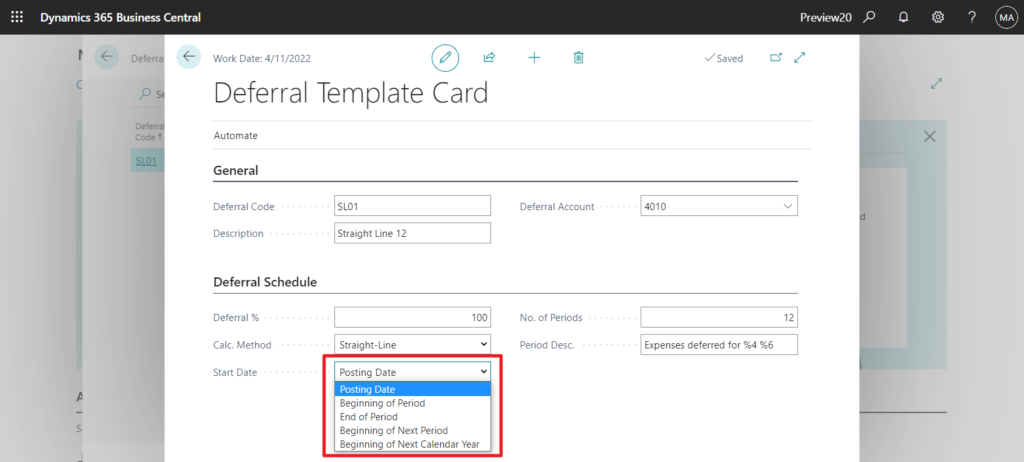

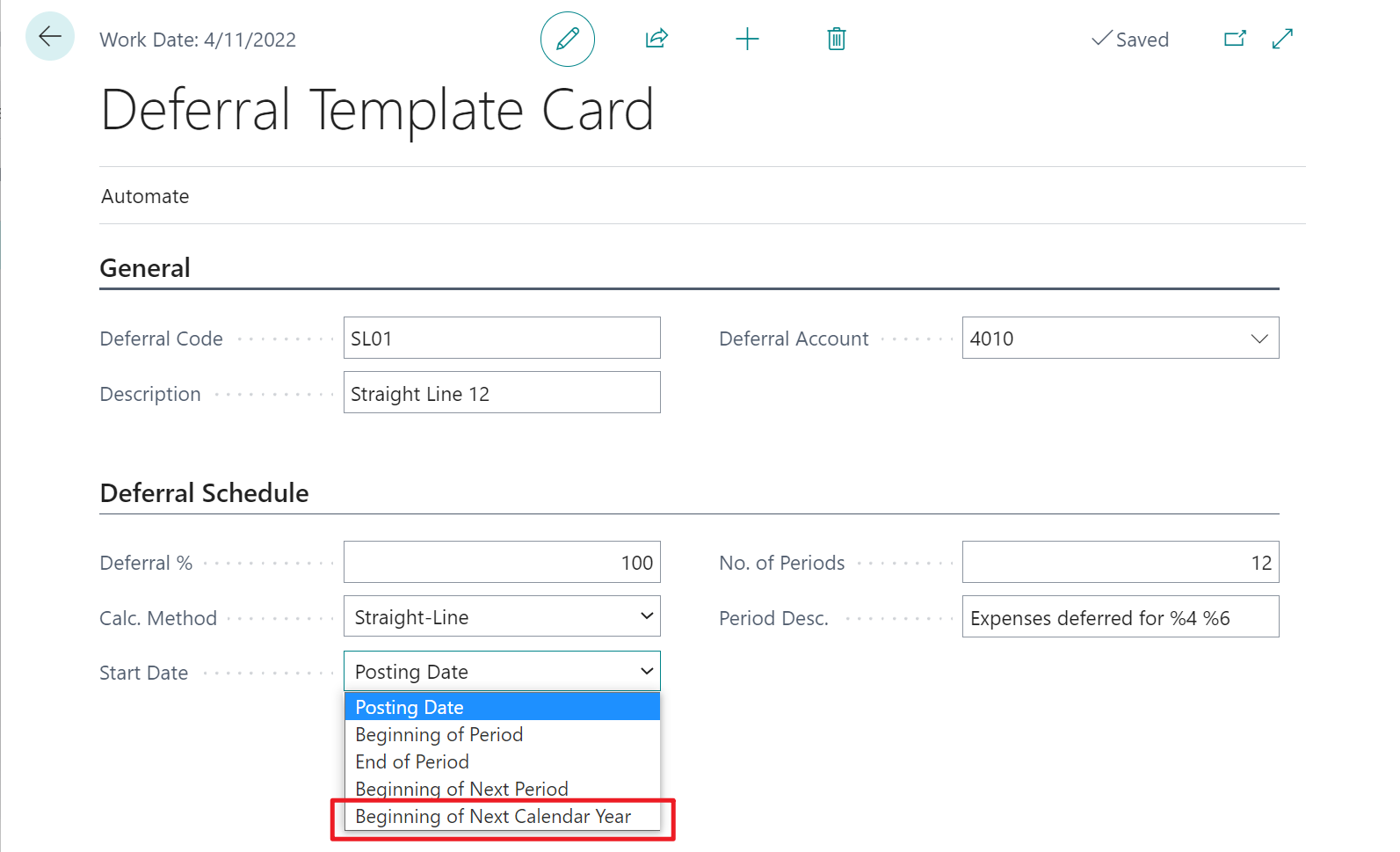

Choose the Tell me icon, enter Deferral Templates, and then choose the related link.

Choose New.

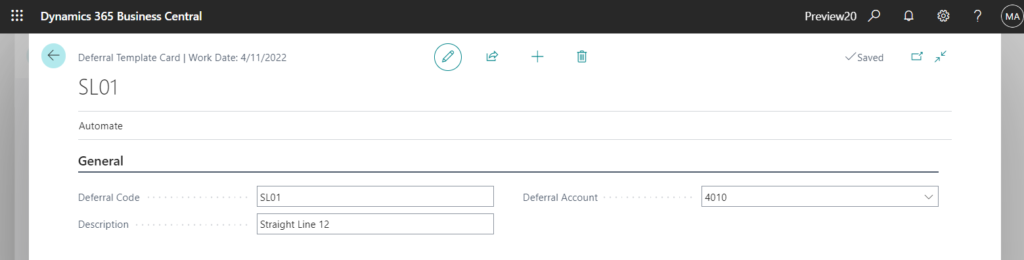

In the General group, enter Deferral Code, Description for the Deferral Template. And select a Deferral Account from chart of accounts.

The important settings are in the Deferral Schedule group, so let’s review them.

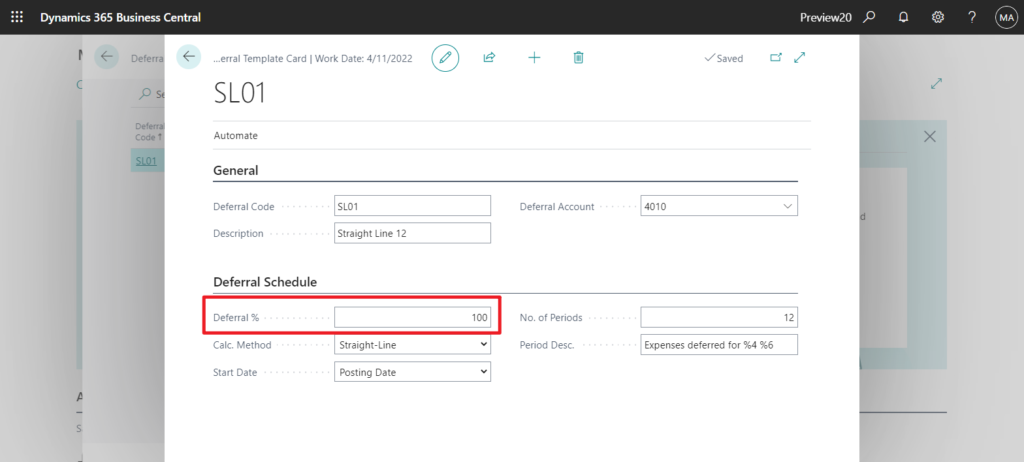

In the Deferral % field, Specifies how much of the total amount will be deferred. For example, if you have set up only 70%, you would have the 30% being posted directly and then the 70% being deferred.

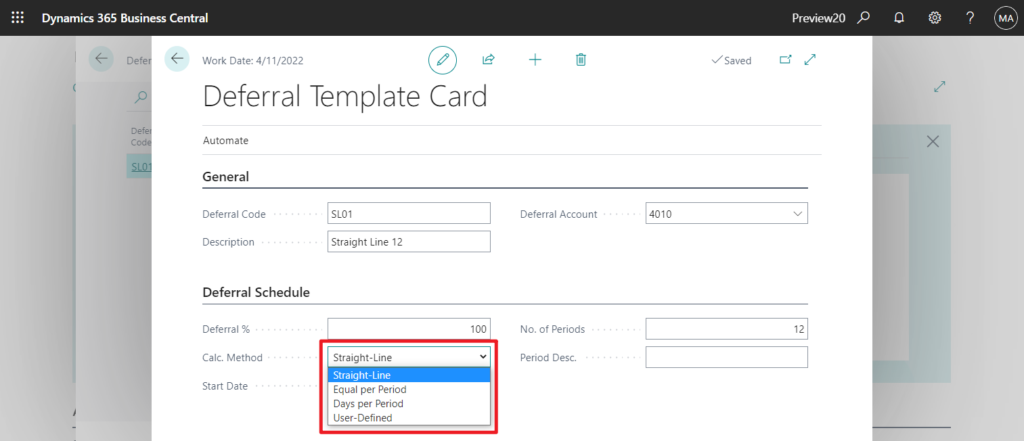

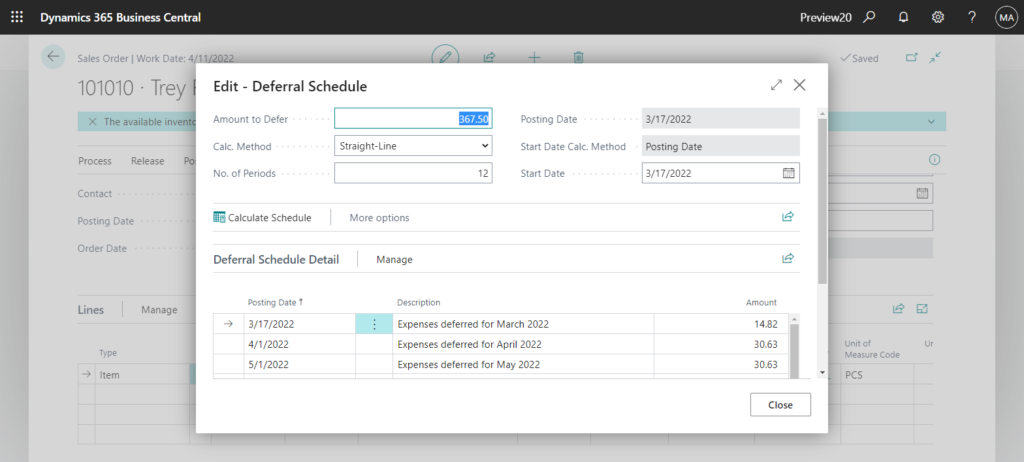

In the Calc. Method field, specify how the Amount field for each period on the Deferral Schedule page is calculated. You can choose between the following options:

- Straight-Line: The periodic deferral amounts are calculated according to the number of periods, distributed according to period length.

- Equal Per Period: The periodic deferral amounts are calculated according to the number of periods, distributed evenly on periods.

- Days Per Period: The periodic deferral amounts are calculated according to the number of days in the period.

- User-Defined: The periodic deferral amounts are not calculated. You must manually fill the Amount field for each period in the Deferral Schedule page. For more information, see the “To change a deferral schedule from a sales invoice” section.

In the Start Date, Specifies when to start calculating deferral amounts. Now we have a new option, Beginning of Next Calendar Year.

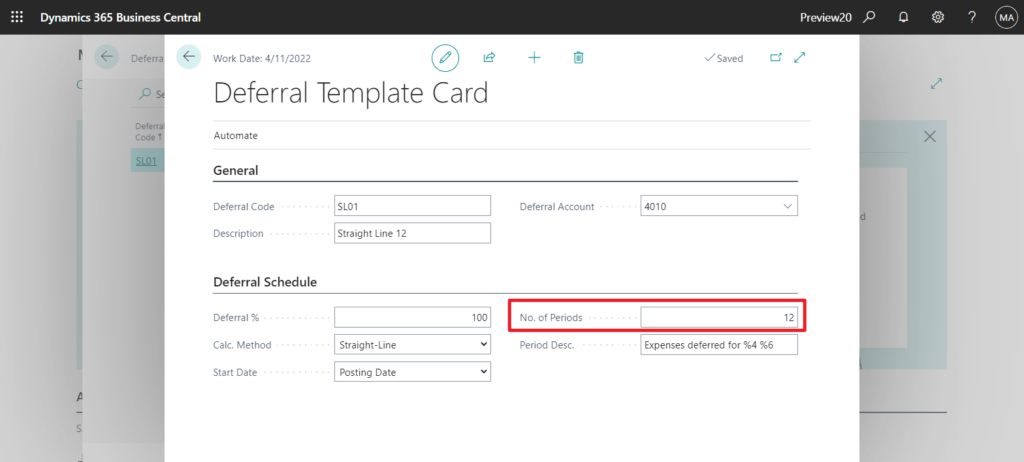

In the No. of Periods, Specifies how many accounting periods the total amounts will be deferred to. For example, 12.

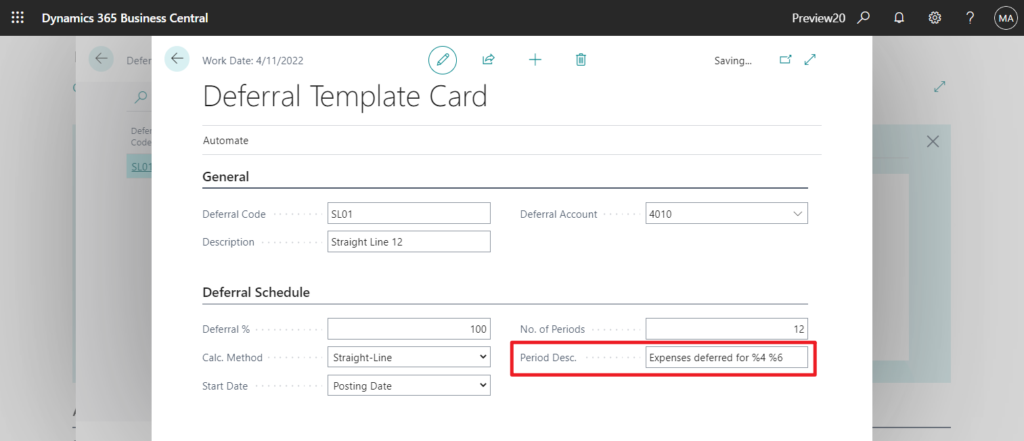

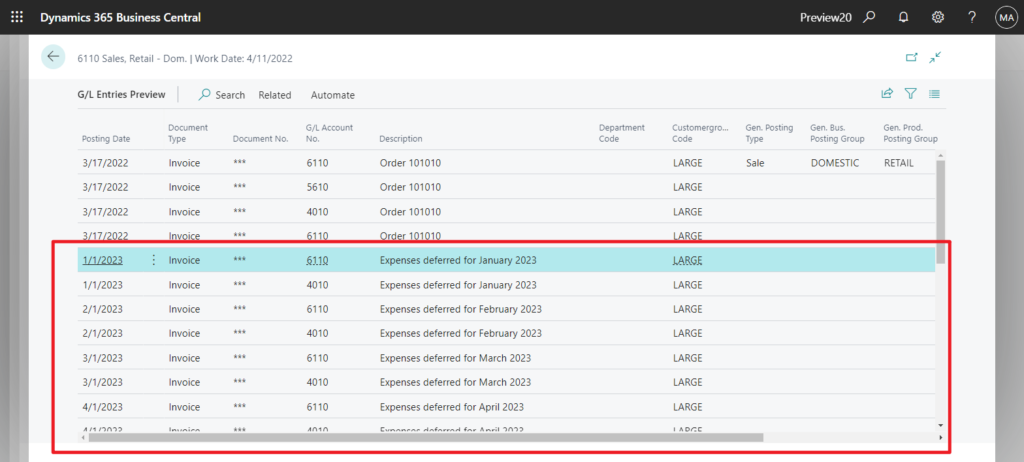

In the Period Desc. field, specify a description that will be shown on entries for the deferral posting. You can enter the following placeholder codes for typical values, which will be inserted automatically when the period description is displayed.

- %1 = The day number of the period posting date

- %2 = The week number of the period posting date

- %3 = The month number of the period posting date

- %4 = The month name of the period posting date

- %5 = The accounting period name of the period posting date

- %6 = The fiscal year of the period posting date

Example: The posting date is 02/06/2016. If you enter “Expenses deferred for %4 %6”, then the description displayed will be “Expenses deferred for February 2016”.

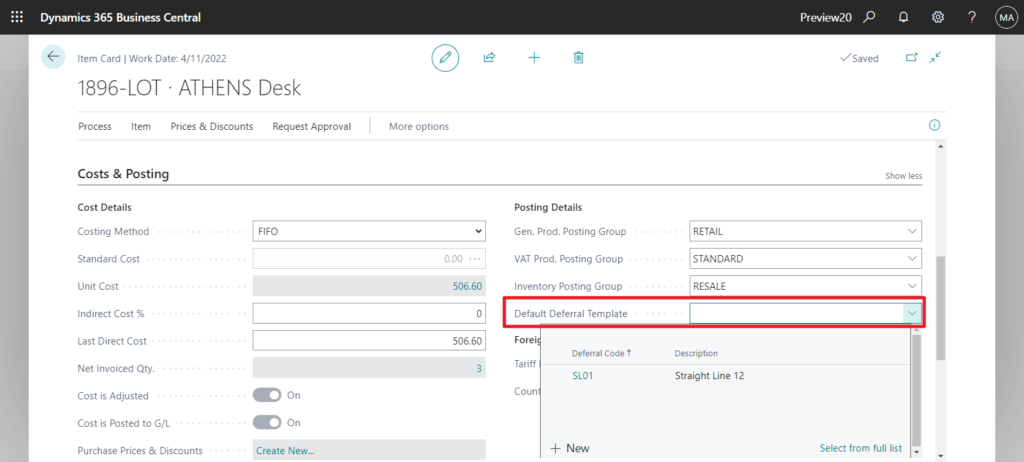

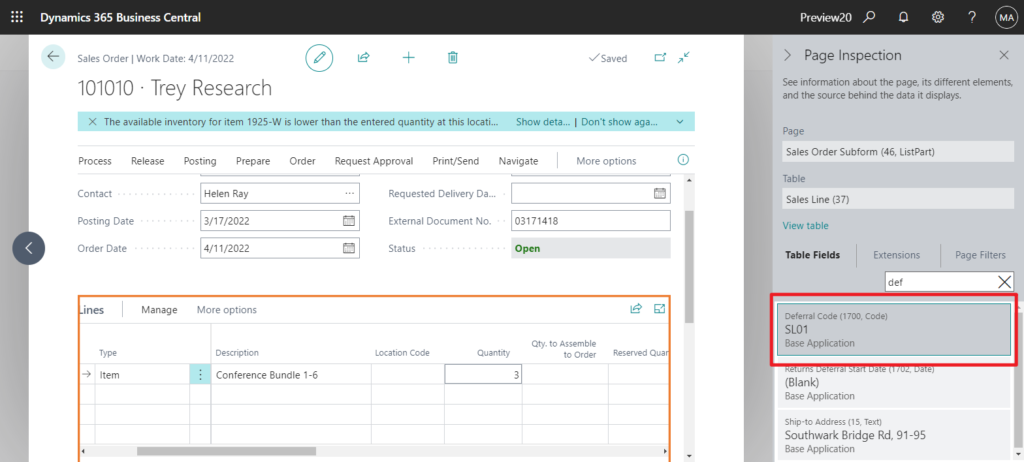

Then you can assign a deferral template to an item.

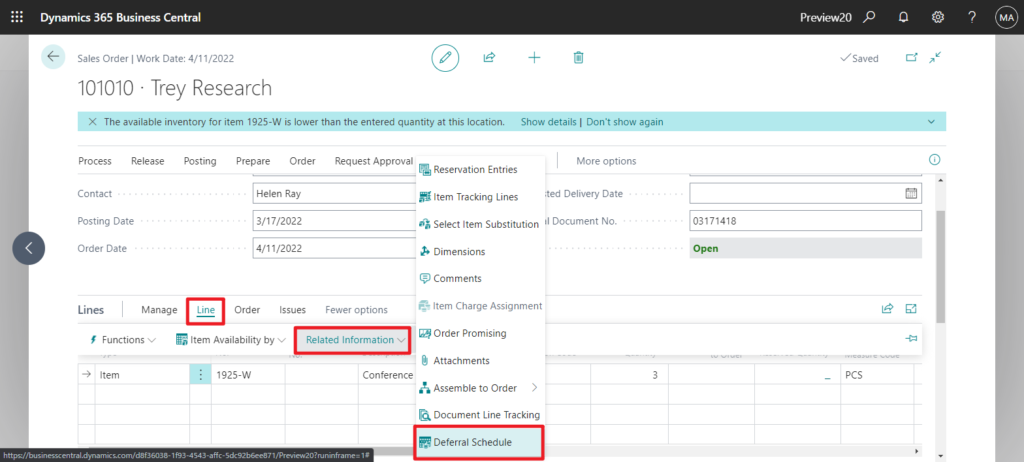

You can change a deferral schedule from a sales document.

Notice that as soon as you enter the item (or resource or G/L account) on the invoice line, the Deferral Code field is filled with the code of the assigned deferral template.

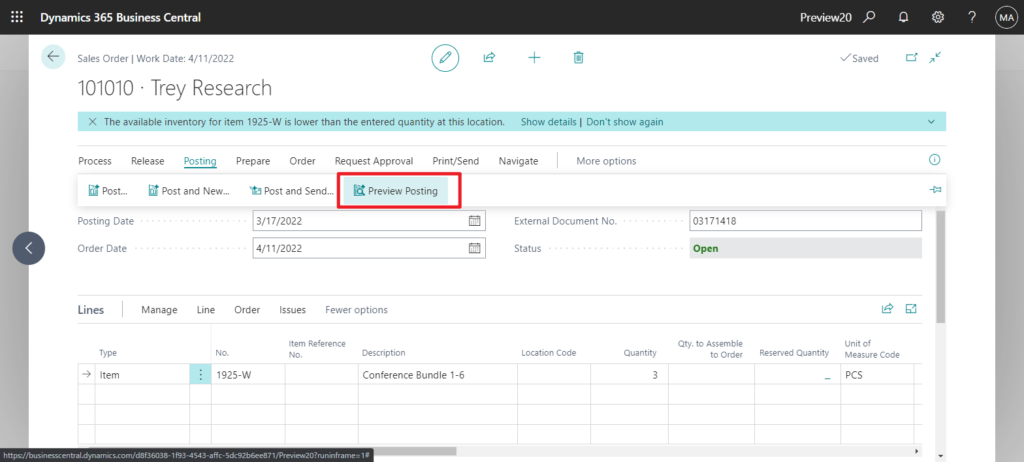

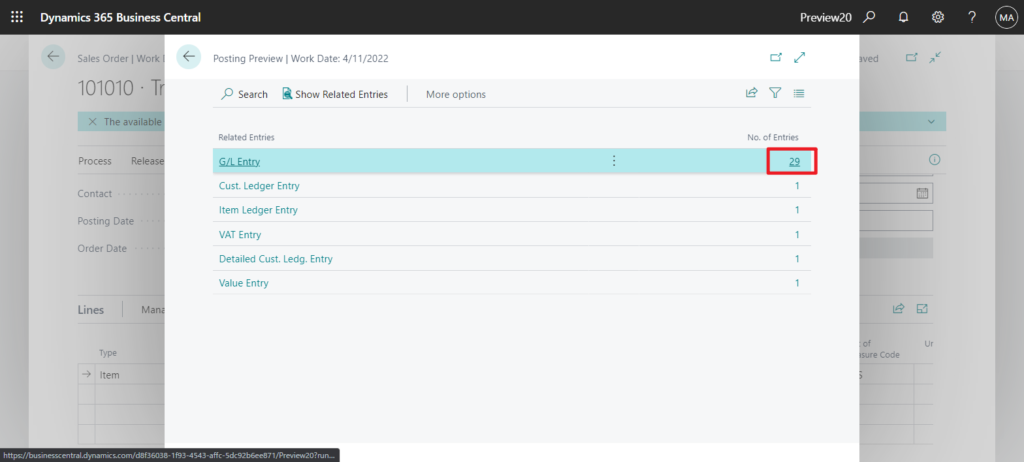

You can choose the Preview Posting action to preview how deferred revenues or expenses will be posted to the general ledger.

For Beginning of Next Calendar Year:

PS:

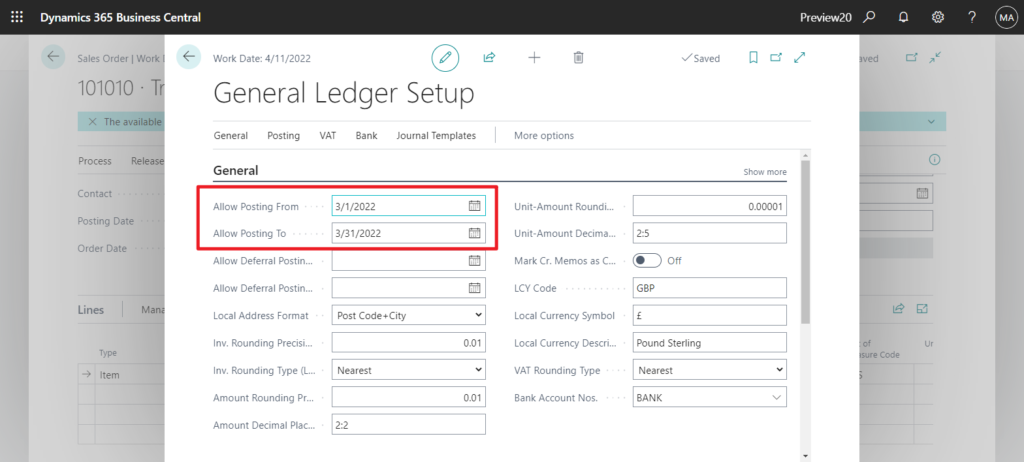

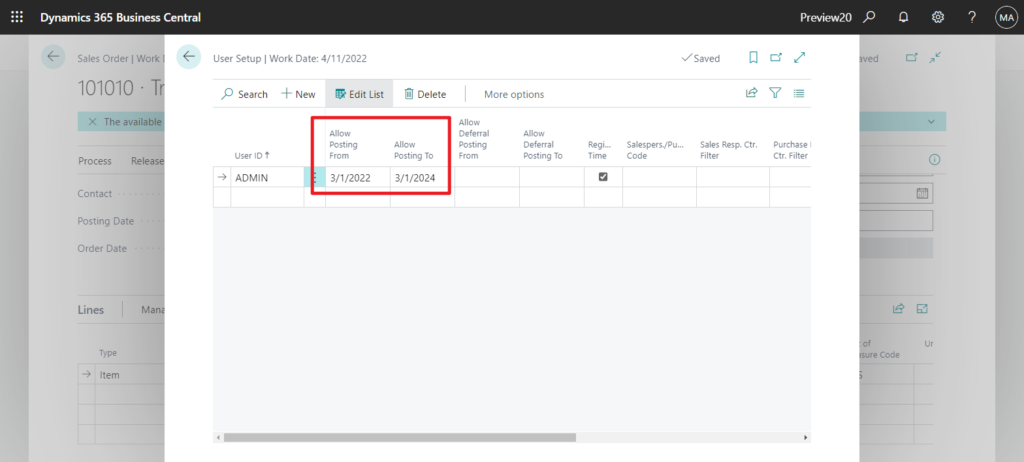

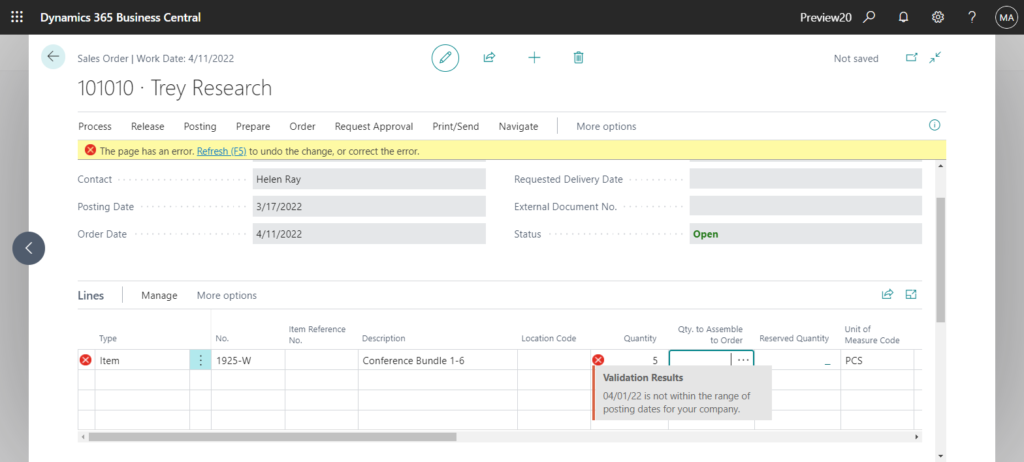

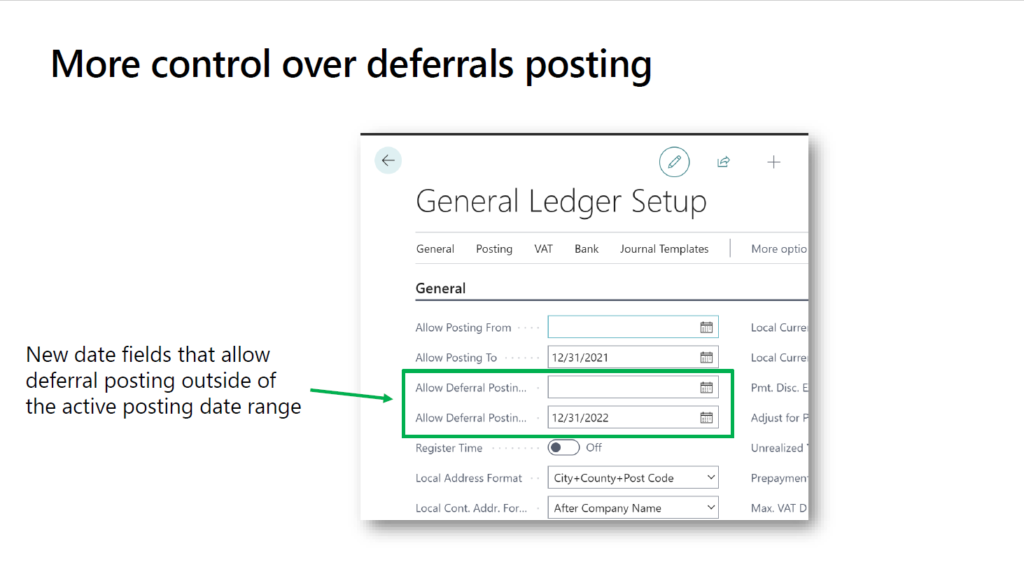

You can define periods during which you allow people to post deferrals for specific users on the G/L Setup page, and for users on the User Setup page by entering dates in the Allow Deferral Posting From and Allow Deferral Posting To fields. This lets people post deferral entries in a future period, even though the Allow Posting From/To fields block other entries.

Otherwise there will be an error when selecting an item that has a deferral template assigned.

You can find more about Defer Revenues and Expenses in Microsoft Docs.

Update info from Dynamics 365 Business Central Launch Event 2022 Release Wave 1:

END

Hope this will help.

Thanks for reading.

ZHU

コメント