Hi, Readers.

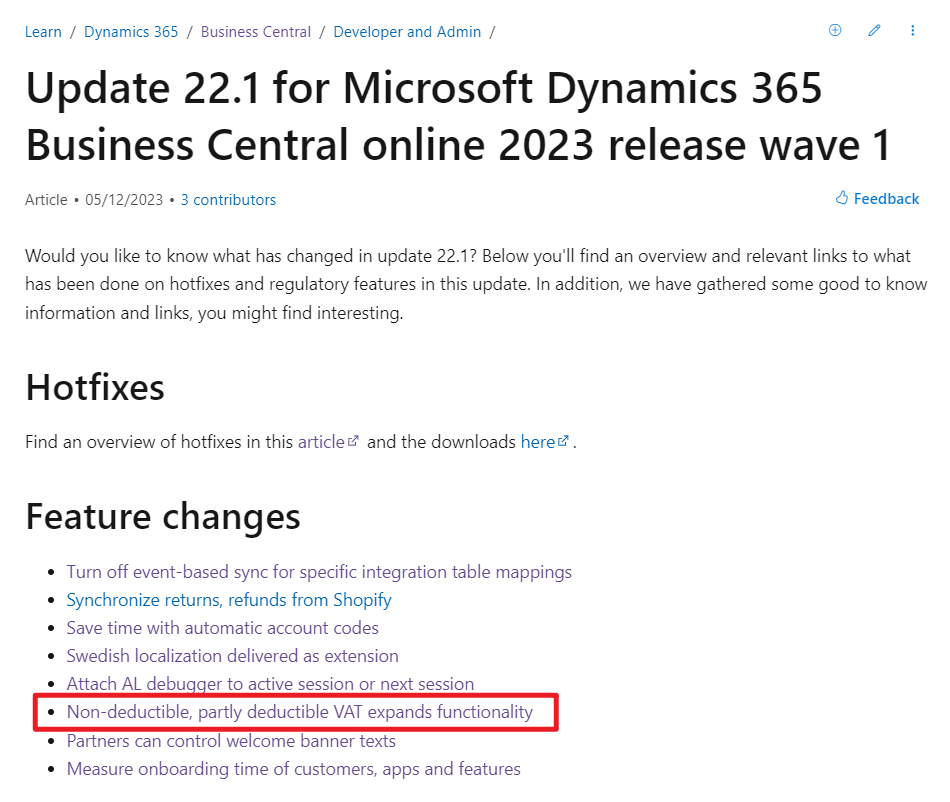

Minor update 22.1 for Business Central 2023 release wave 1 has just been released. Learn more: Link.

I will continue to test and share some new features that I hope will be helpful.

Today I would like to talk about Non-deductible, partly deductible VAT expands functionality.

This feature is mentioned in What’s new and planned for update 22.1 for Microsoft Dynamics 365 Business Central 2023 release wave 1.

Non-deductible, partly deductible VAT expands functionality

Business value:

Users in all relevant regions have improved VAT functionality with non-deductible and partly deductible VAT enabled.

https://learn.microsoft.com/en-us/dynamics365/release-plan/2023wave1/smb/dynamics365-business-central/non-deductible-partly-deductible-vat-expands-functionality

The following is an introduction to this feature from Microsoft:

Business Central lets businesses calculate deductible and non-deductible VAT amounts. You can configure VAT so that it isn’t deducted for purchases under certain conditions:

- The type of goods or services purchased. VAT is fully or partially non-deductible by the provision of the law on goods.

- Partially deductible prorated VAT. VAT is prorated according to the ratio between sales operations for which VAT is owed and all operations performed. VAT exceeding this ratio can’t be deducted.

Configure deductions in VAT (percentage and G/L account) on the VAT Posting Setup page. You can configure full or partial deductions for combinations of VAT posting groups.

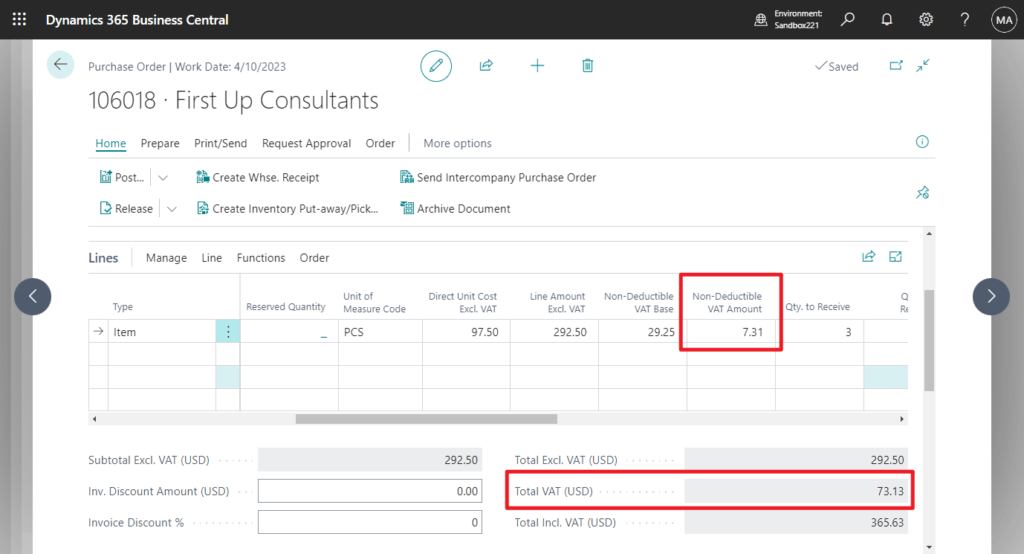

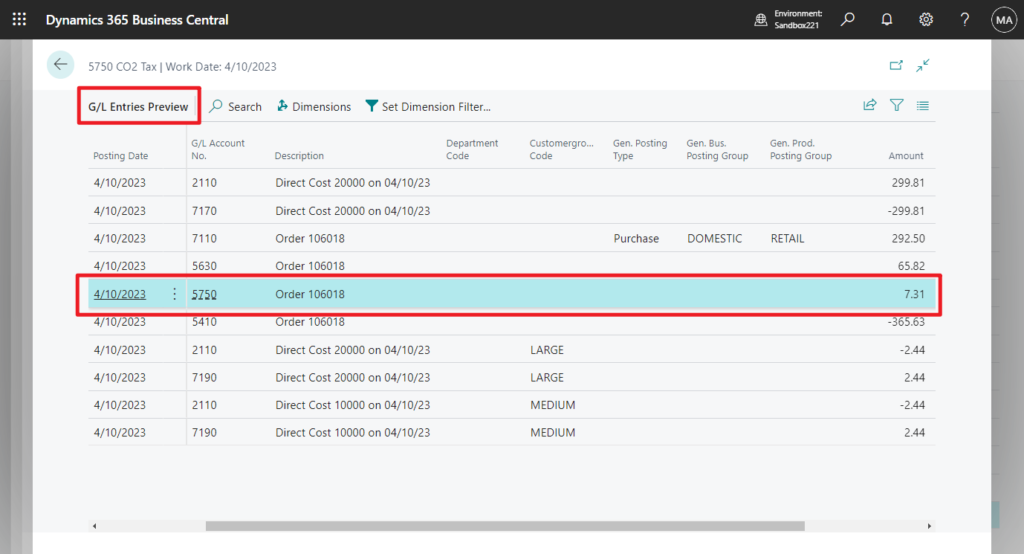

Before you post a document, the details are available in statistics. When you post a purchase document, the results are available on the G/L entries and VAT entries. Non-deductible VAT also works with Reverse Charge VAT and Deferrals.

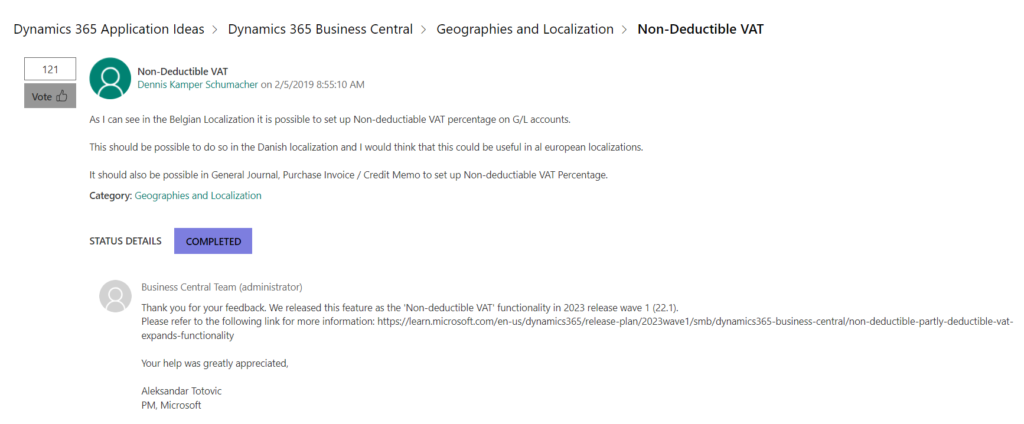

Well, as far as I know, this was first proposed in BC Ideas about three years ago. Microsoft released this feature as the ‘Non-deductible VAT’ functionality in 2023 release wave 1 (22.1).

More details: Non-Deductible VAT

Let’s see more details.

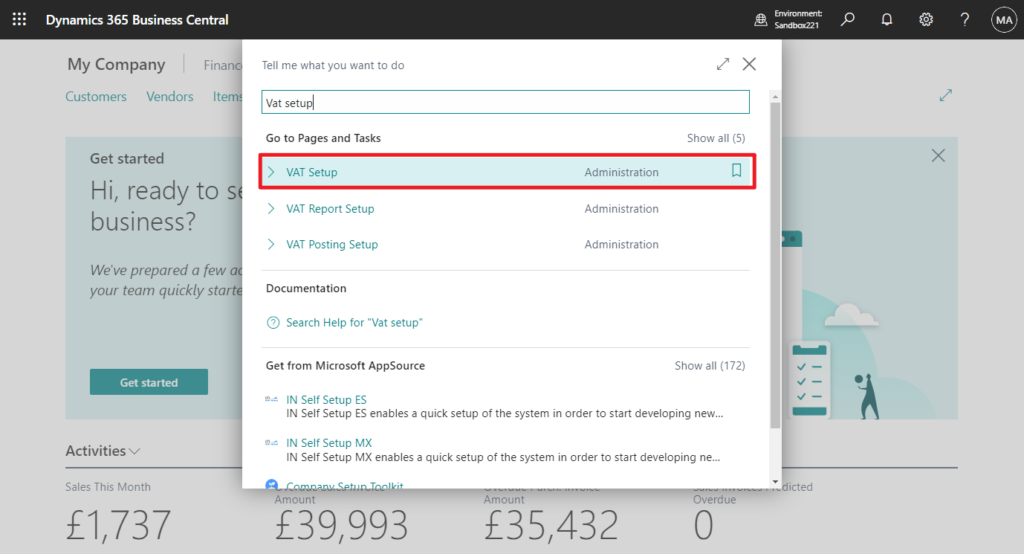

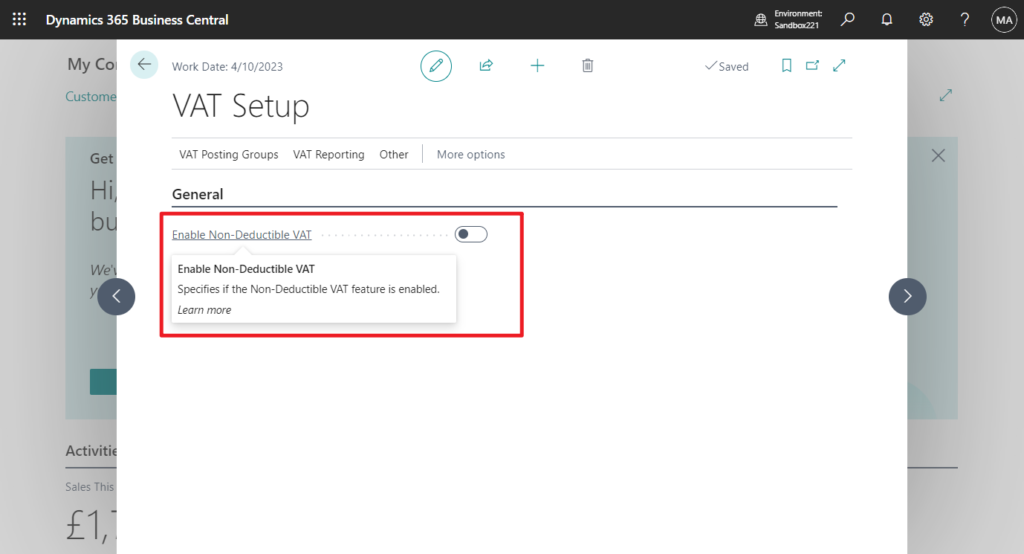

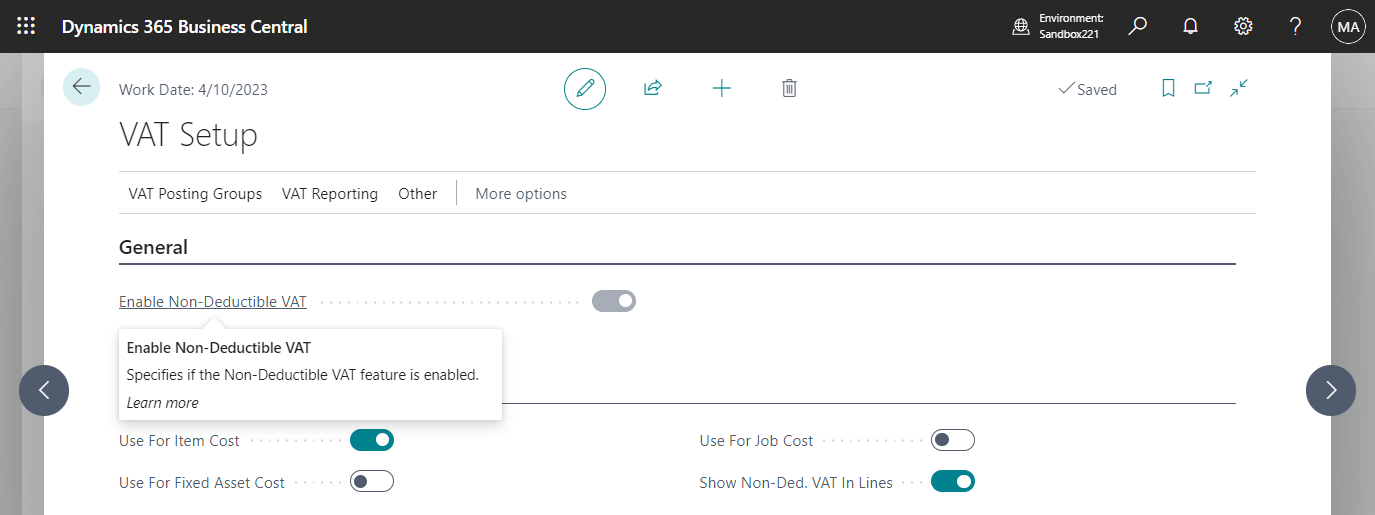

In BC22.1, Microsoft added a new VAT Setup page.

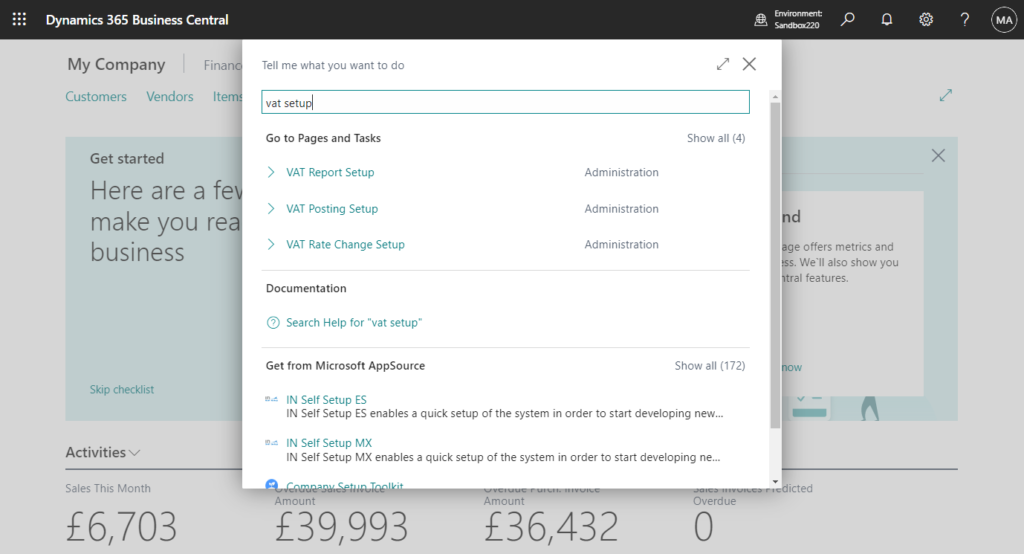

PS: In BC22.0

You can enable Non-Deductible VAT feature on this page.

Enable Non-Deductible VAT

Specifies if the Non-Deductible VAT feature is enabled.

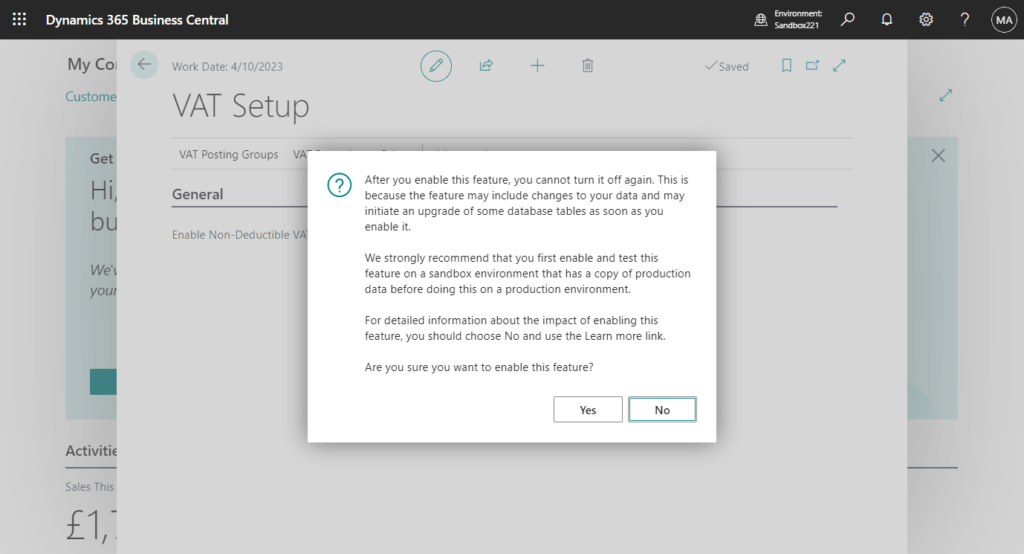

After you enable this feature, you cannot turn it off again.

After you enable this feature, you cannot turn it off again. This is because the feature may include changes to your data and may initiate an upgrade of some database tables as soon as you enable it.

We strongly recommend that you first enable and test this feature on a sandbox environment that has a copy of production data before doing this on a production environment.

For detailed information about the impact of enabling this feature, you should choose No and use the Learn more link.

Are you sure you want to enable this feature?

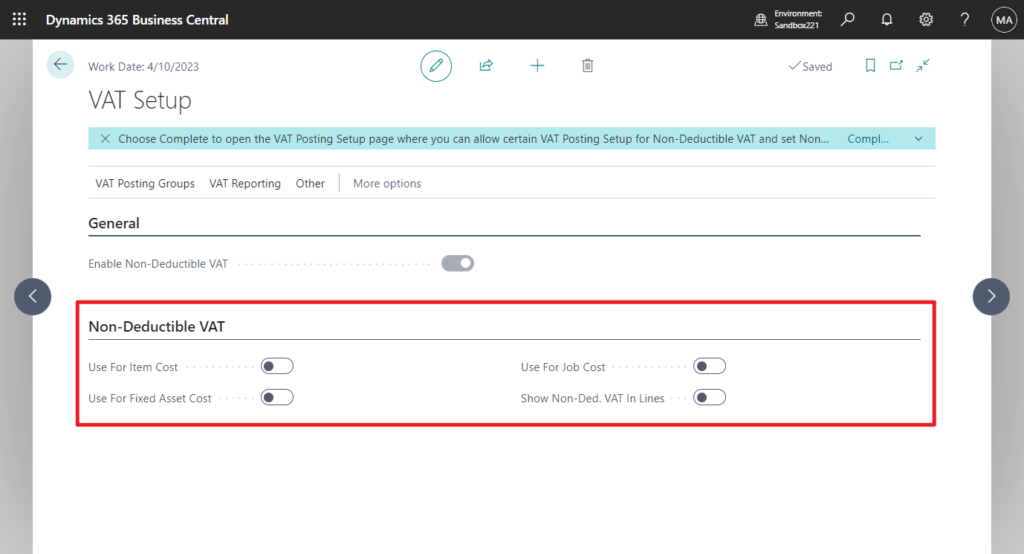

After enabling, the Non-Deductible VAT group will be displayed on the page, you can append the following settings.

Use For Item Cost

Specifies if the non-deductible VAT must be added to the item cost.

Use For Fixed Asset Cost

Specifies if the non-deductible VAT must be added to the fixed asset cost.

Use For Job Cost

Specifies if the non-deductible VAT must be added to the job cost.

Show Non-Ded. VAT In Lines

Specifies if the non-deductible VAT must be shown in document lines pages.

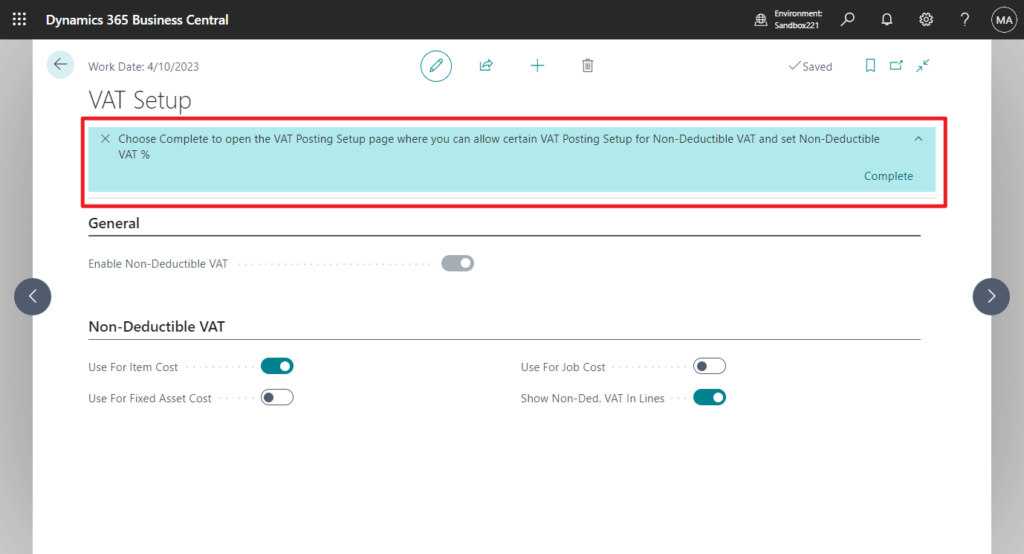

You can also see the following notification: Choose Complete to open the VAT Posting Setup page.

Choose Complete to open the VAT Posting Setup page where you can allow certain VAT Posting Setup for Non-Deductible VAT and set Non-Deductible VAT %

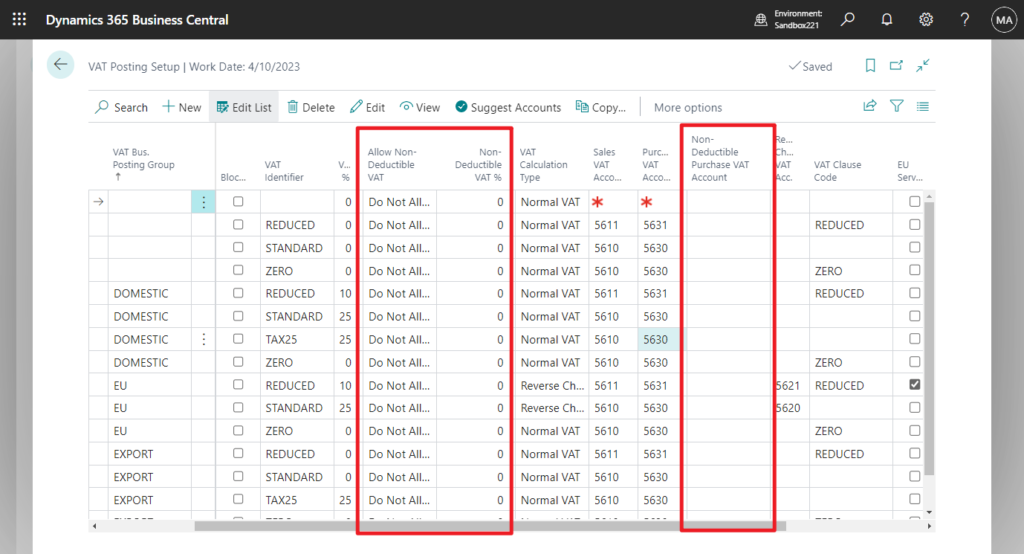

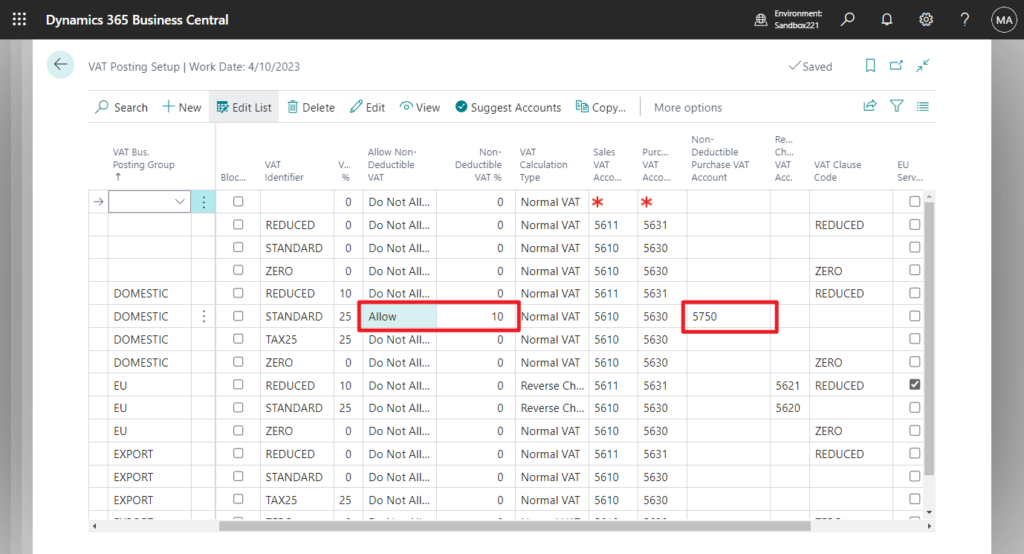

On the VAT Posting Setup page, there are also three new fields.

Allow Non-Deductible VAT

Specifies whether the Non-Deductible VAT is considered for this particular combination of VAT business posting group and VAT product posting group.

Non-Deductible VAT %

Specifies the percentage of the transaction amount to which VAT is not applied.

Non-Deductible Purchase VAT Account

Specifies the account associated with the VAT amount that is not deducted due to the type of goods or services purchased.

For example,

Create a purchase order and preview post.

I think this function may be helpful for some special industries or the local needs of certain countries. Give it a try!!!😁

PS: Aleksandar Totovic also brought us a short explanatory video yesterday, you can check it out directly.

Non-deductible VAT is finally live in #MSDyn365BC (v22.1). I want to share a short video how to easily set up it.

Update:

END

Hope this will help.

Thanks for reading.

ZHU

コメント