Hi, Readers.

The preview environment for Dynamics 365 Business Central 2022 release wave 1 (BC20) is available. Learn more: Link

I will continue to test and share some new features that I hope will be helpful.

Business value:

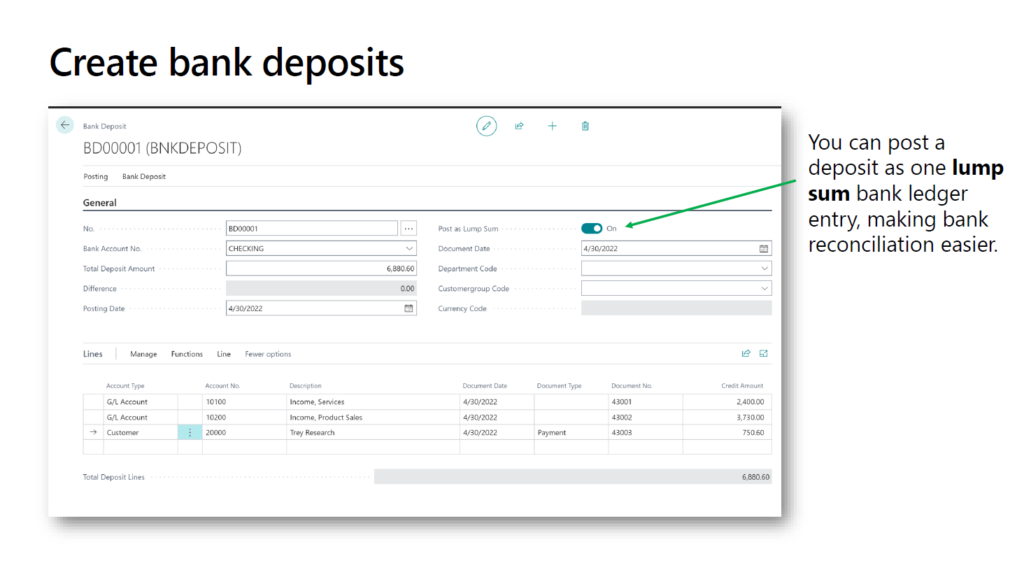

With bank deposits, you post all transactions that are included in a single bank deposit. If you post a lump sum, it makes bank reconciliations easier to do. Also, if you need to register deposits that cover more than one business transaction, you’ll probably find that you prefer to use deposits instead of general journal entries.

https://docs.microsoft.com/en-us/dynamics365-release-plan/2022wave1/smb/dynamics365-business-central/bank-deposits

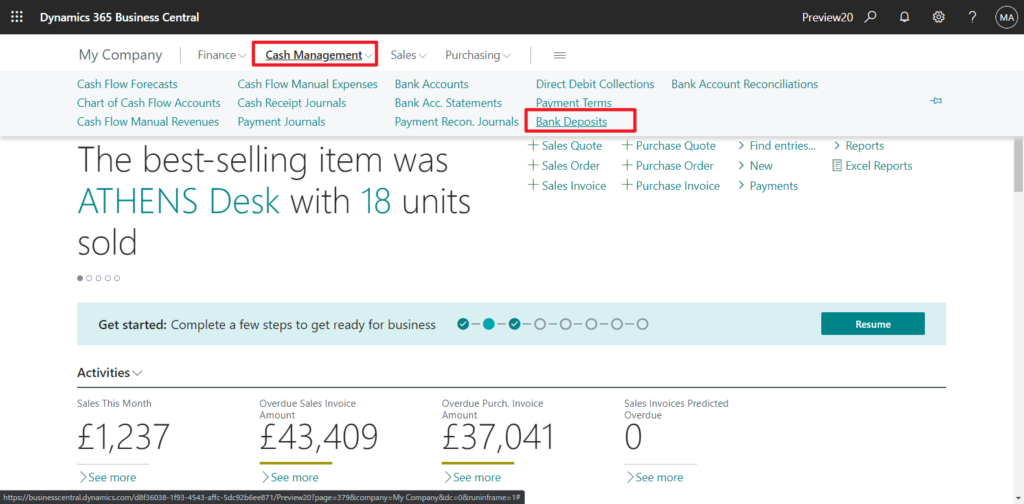

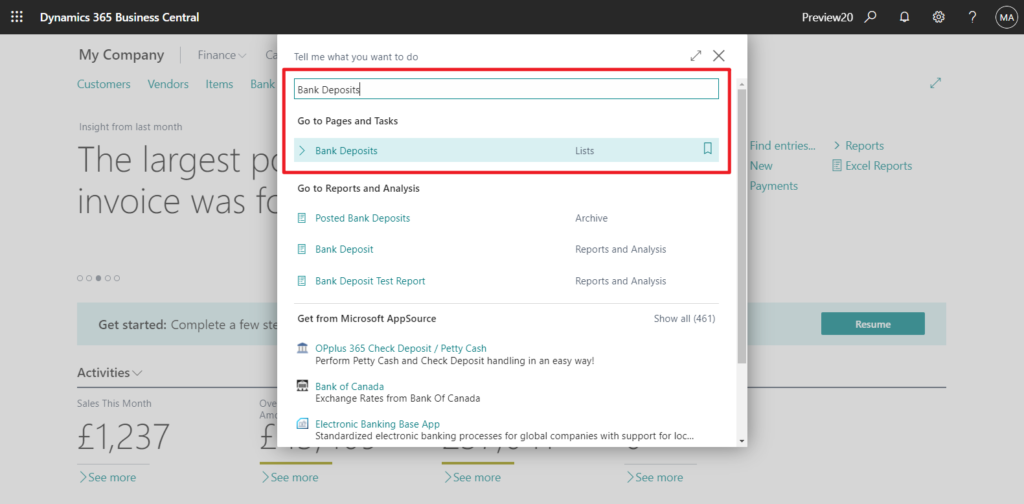

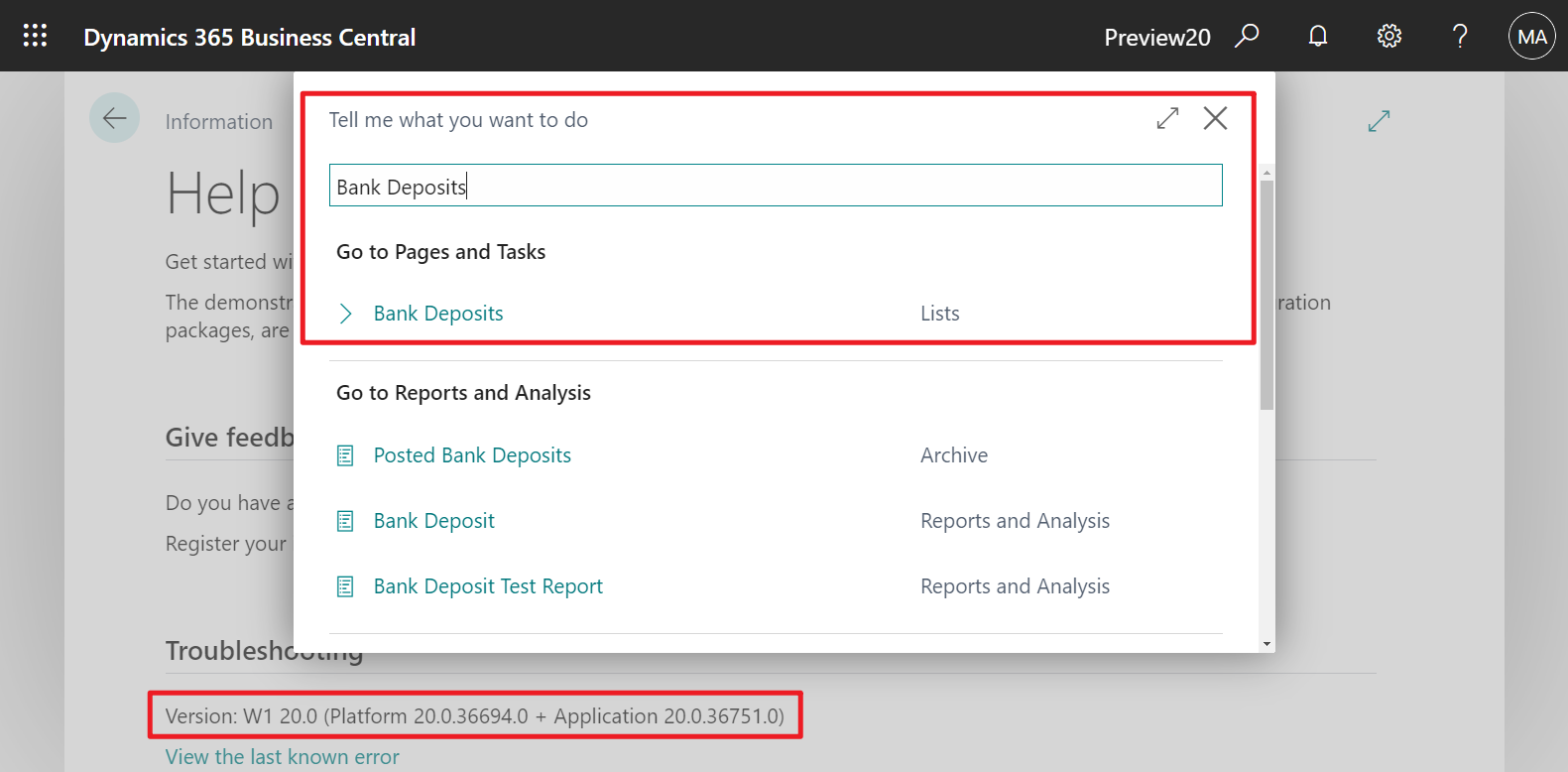

In Business Central 2022 wave 1 (BC20), you can find the bank deposits capabilities under Cash Management on the Business Manager and Accountant Role Centers, but you can also use Tell Me to search for the Bank Deposits page, for example.

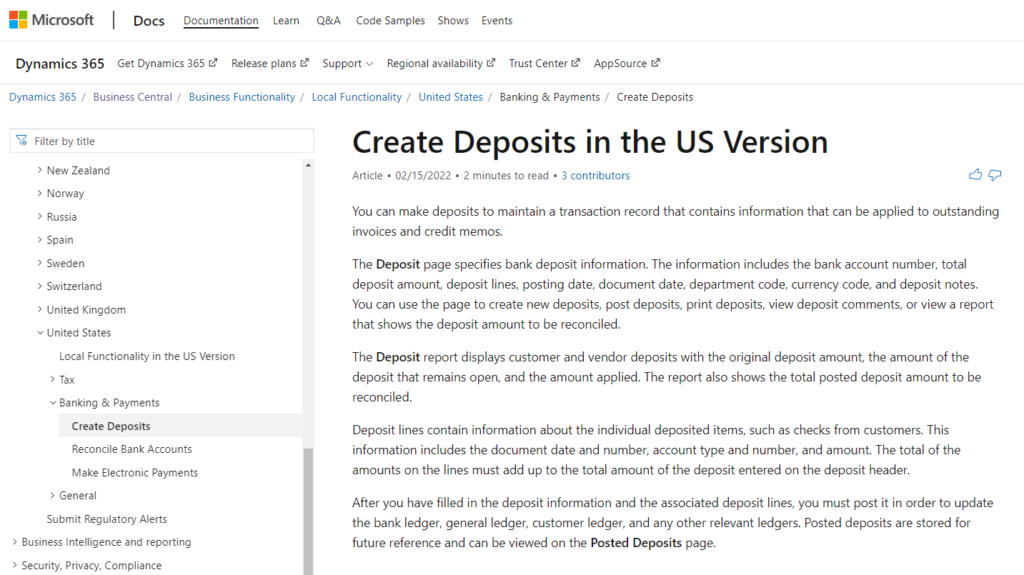

So is this a completely new feature? No, if you are a user or partner with the US version, you should have noticed that this is a localization feature for the US. More details: Create Deposits in the US Version

Starting from Business Central 2022 wave 1 (BC20), Microsoft migrated this feature to the W1 version. Let’s take a brief look at what the differences are between the two versions of this feature.

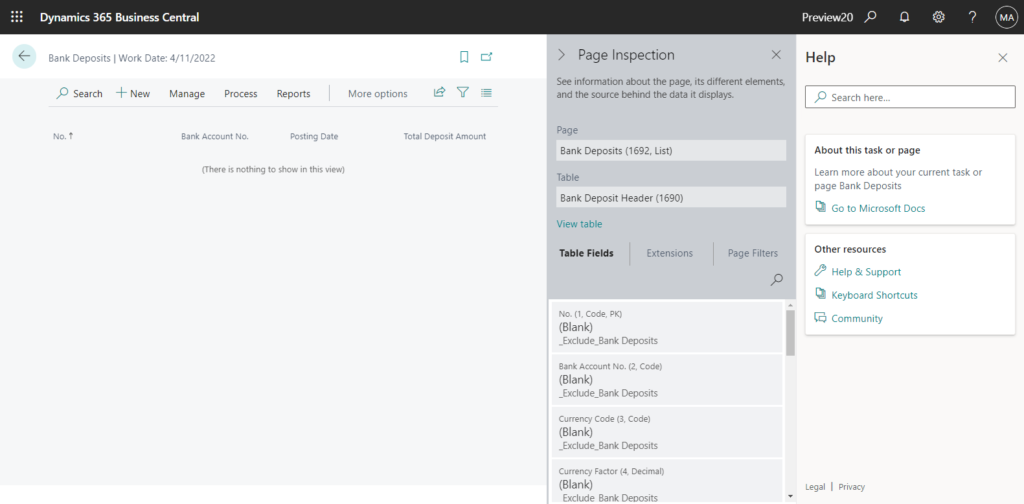

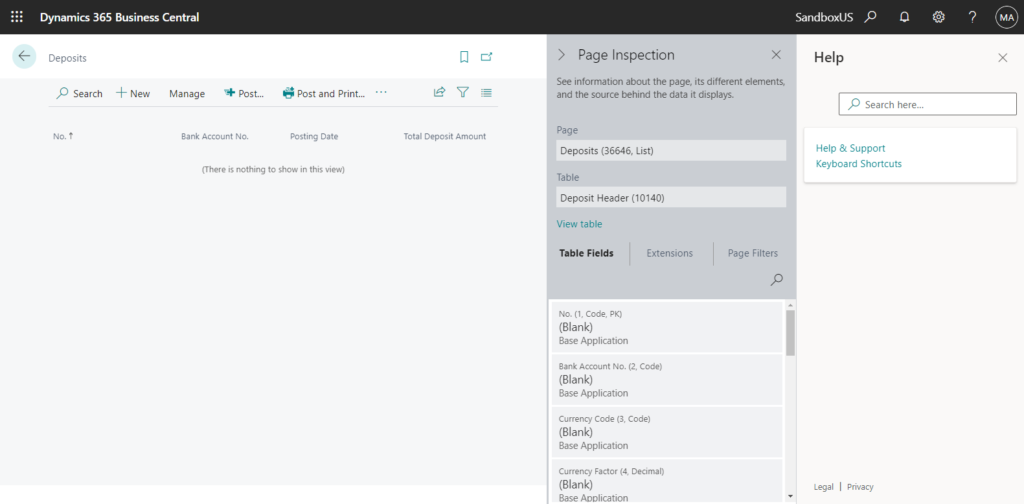

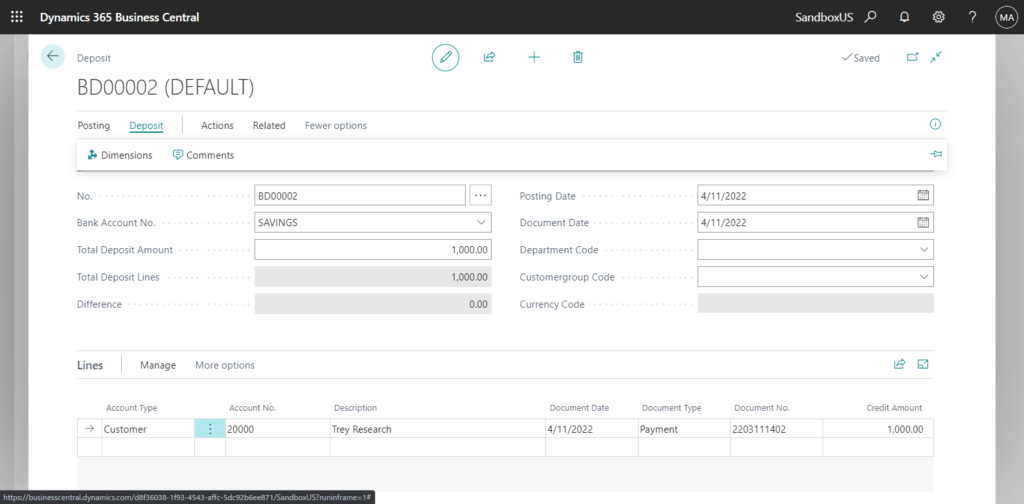

Deposits List page in BC20.0 Preview:

Deposits List page in BC19.5 US:

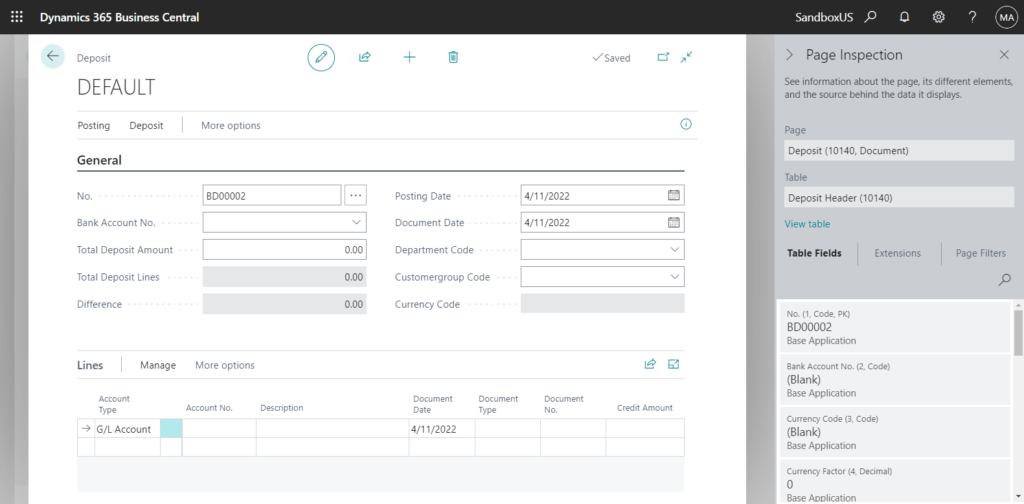

Deposits Card page in BC20.0 Preview:

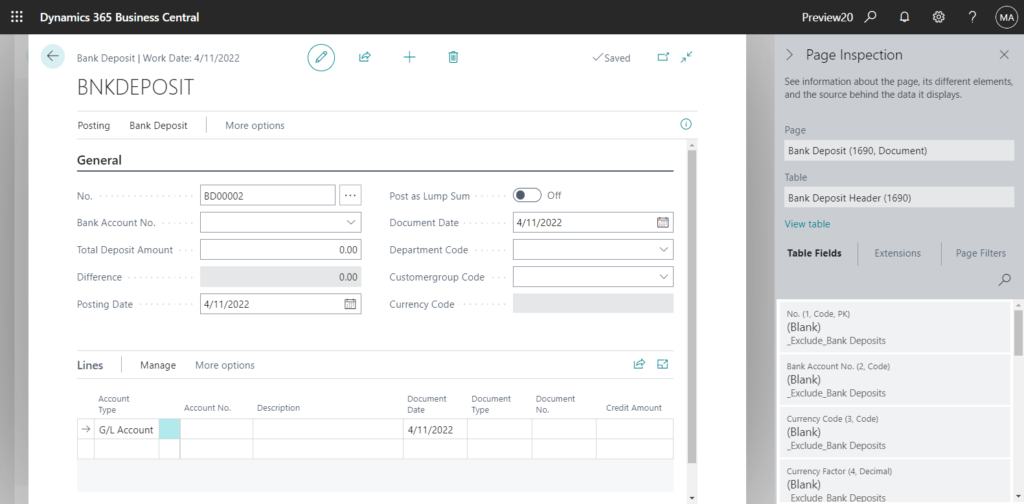

Deposits Card page in BC19.5 US:

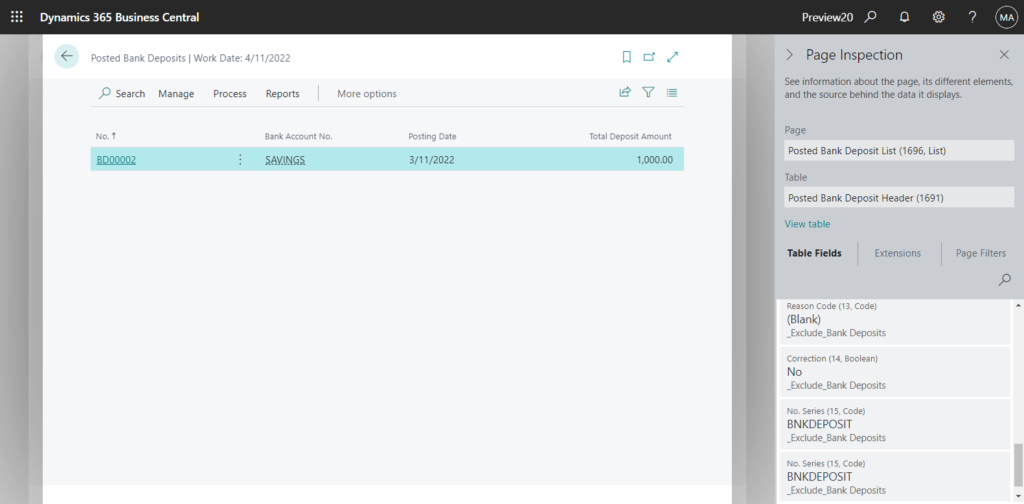

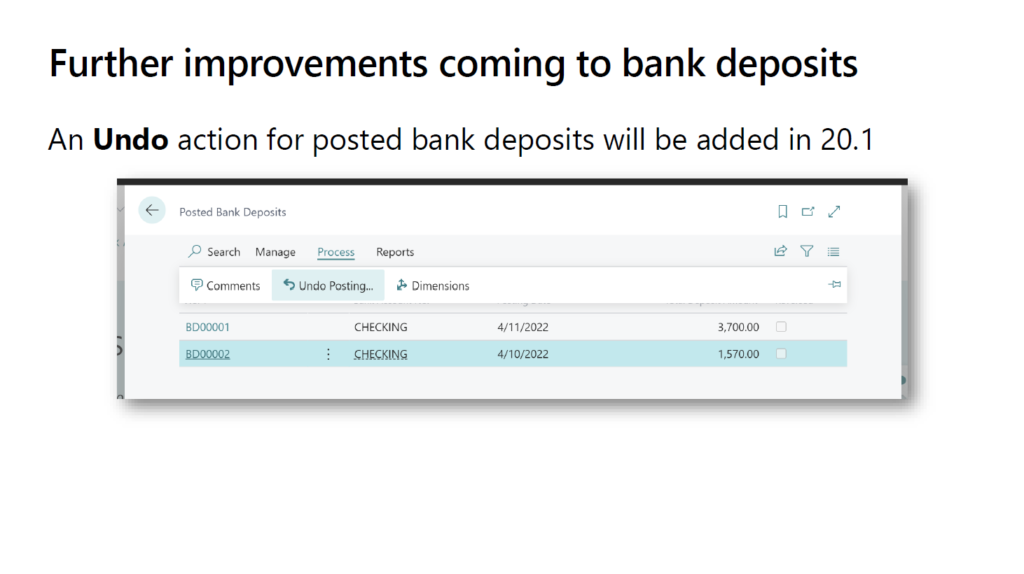

Posted Deposit List page in BC20.0 Preview:

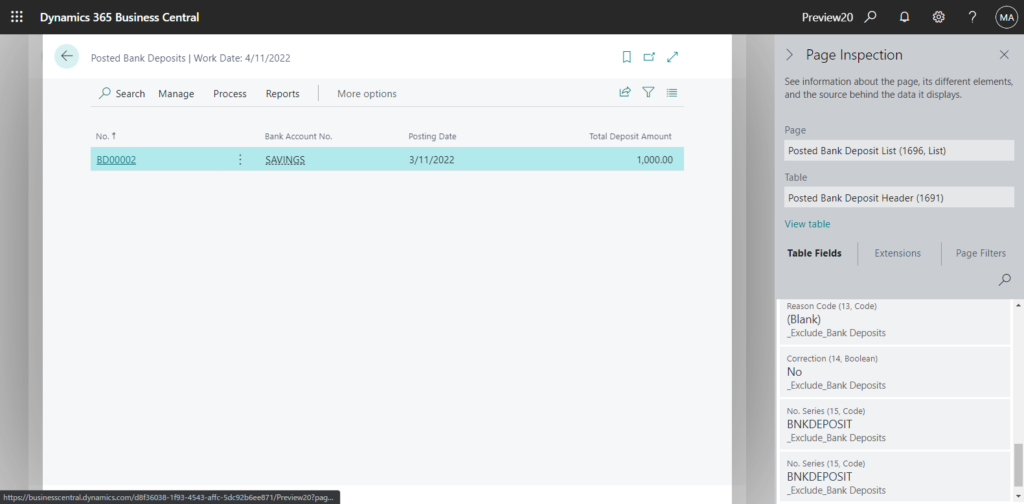

Posted Deposit list page in BC19.5 US:

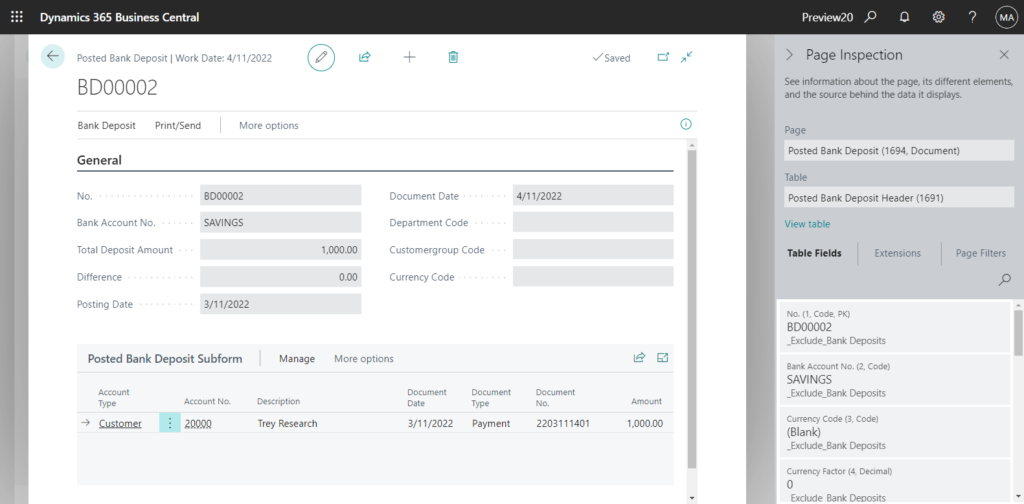

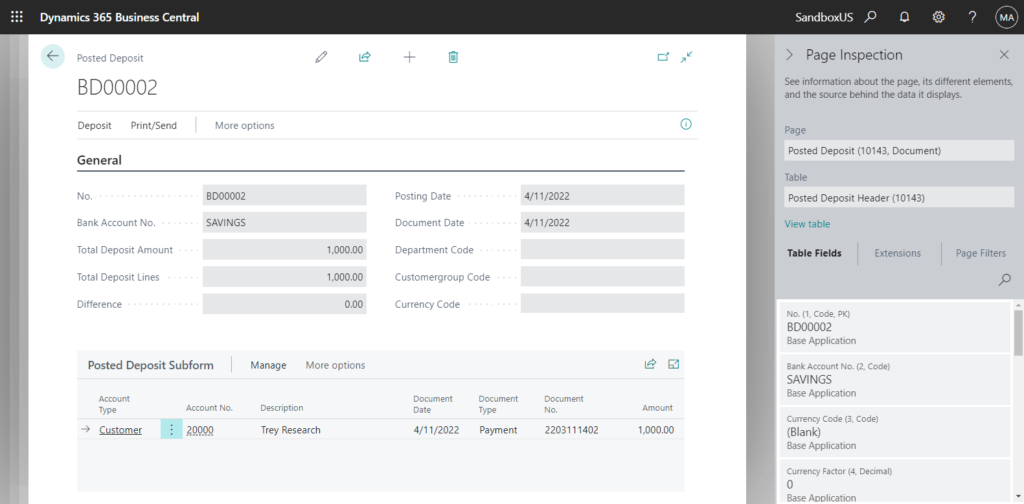

Posted Deposit Card page in BC20.0 Preview:

Posted Deposit Card page in BC19.5 US:

The features in both versions is very similar except for the Object IDs.

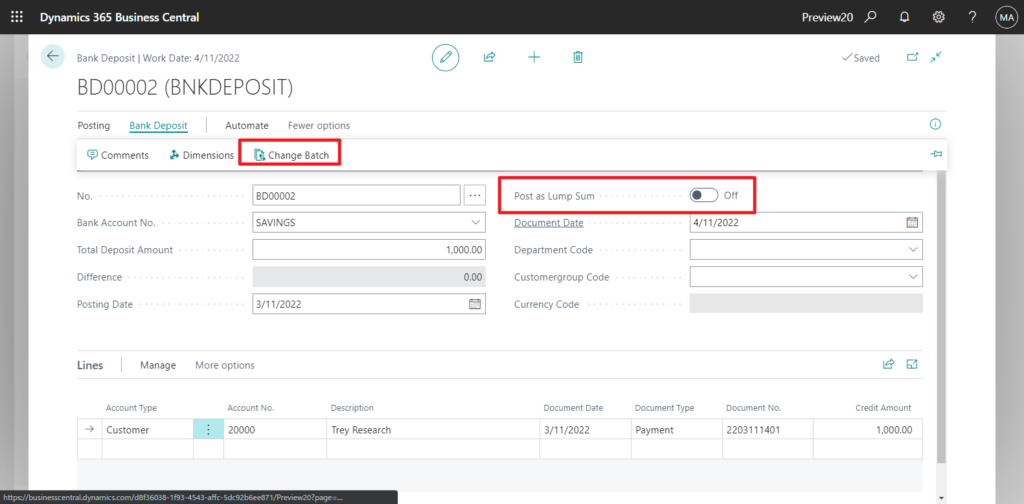

Of course, there are some new features in the BC20.0 Preview.

In BC19.5 US

More info about Bank Deposits:

Feature details:

With bank deposits, you can maintain a transaction record that contains information that can be applied to outstanding invoices and credit memos.

By using bank deposits, you can easily view all transactions included in a deposit. And it makes bank reconciliation easier. This makes deposits the preferred approach, compared to normal general journal entries for registering deposits that cover more than one business transaction.

The Bank Deposit page specifies the bank account deposited into, total deposit amount, posting date, document date, dimensions, currency code, as well as the deposit lines.

Deposit lines contain information about the individual deposited items, such as checks from customers, cash sales revenue, or refunds from vendors. This information includes the document date and number, account type and number, and amount. The total of the amounts on the deposit lines must add up to the total amount of the deposit entered on the deposit header before posting the deposit.

After you enter information about a deposit and add deposit lines, you must post the deposit to update the relevant ledgers, such as the bank ledger, general ledger, or customer ledger. The details about posted bank deposits are stored for future reference and are available on the Posted Bank Deposits page. Alternatively, you can also access the details when you do bank reconciliations.

The Deposit report displays customer and vendor deposits with the original deposit amount, the amount of the deposit that is still open, and the amount applied. The report also shows the total posted deposit amount to reconcile.

https://docs.microsoft.com/en-us/dynamics365-release-plan/2022wave1/smb/dynamics365-business-central/bank-deposits

Update info from Dynamics 365 Business Central Launch Event 2022 Release Wave 1:

END

Hope this will help.

Thanks for reading.

ZHU

コメント