Hi, Readers.

The preview environment for Dynamics 365 Business Central 2022 release wave 1 (BC20) is available. Learn more: Link

I will continue to test and share some new features that I hope will be helpful.

Block VAT and General Posting Setups:

Business value:

When you start using Business Central with your company’s data, you want to get started fast. During the learning phase, you might have made mistakes in how you set up value-added tax (VAT) posting, tax posting, or general posting. Also, company policies might change, resulting in making some posting setups obsolete. Blocking such setups helps users comply with company posting policies. This way, you’re of assured consistent posting, because only the valid setup can be used.

Feature details:

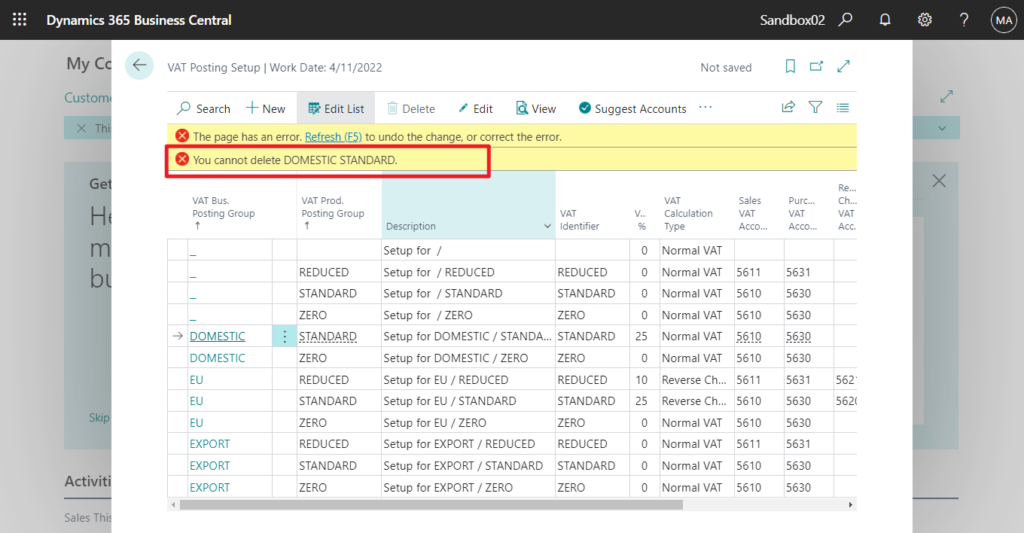

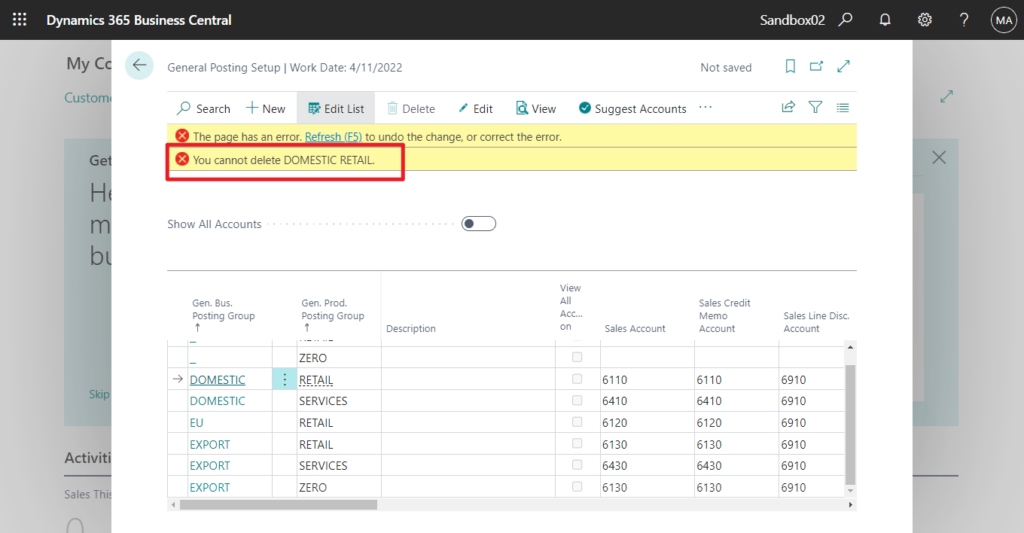

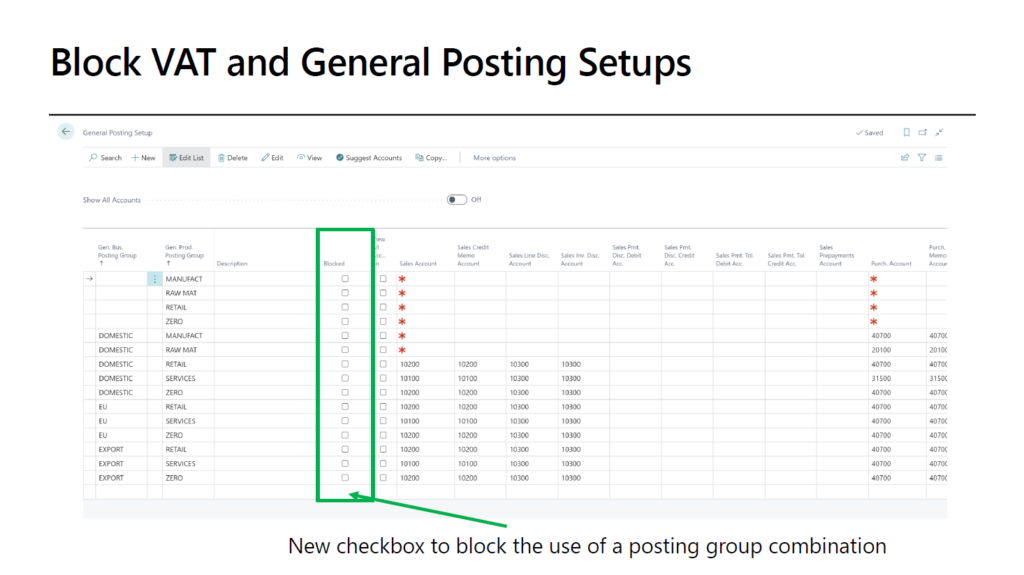

To support you in getting started fast, Business Central will show you notifications if you are missing general ledger (G/L) accounts in posting groups or posting setups, such as the VAT/Tax Posting Setup page or the General Posting Setup page. You can turn this on or off using the G/L accounts missing in posting group or setup notification in the My Notifications page, which is part of the My settings page.To take you directly to the relevant posting group or setup that is missing a G/L account, Business Central will automatically create those posting setups, using the posting groups in the document or journal you’re currently working on. At this point, you might just fill in the missing G/L accounts: Then, later, when you further refine the setup, you might realize this setup was wrong. Business Central does not allow the deletion of VAT posting setup and general posting setup when there are entries created based on such configurations. But now you can use the Blocked field in the VAT/Tax Posting Setup or General Posting Setup page to prevent users from mistakenly using old, no longer relevant setup for new postings.

https://docs.microsoft.com/en-us/dynamics365-release-plan/2022wave1/smb/dynamics365-business-central/block-vat-general-posting-setups

Posting groups map entities such as customers, vendors, items, resources, and sales and purchase documents to general ledger accounts. They save time and help avoid mistakes when you post transactions. The transaction values go to the accounts specified in the posting group for that particular entity.

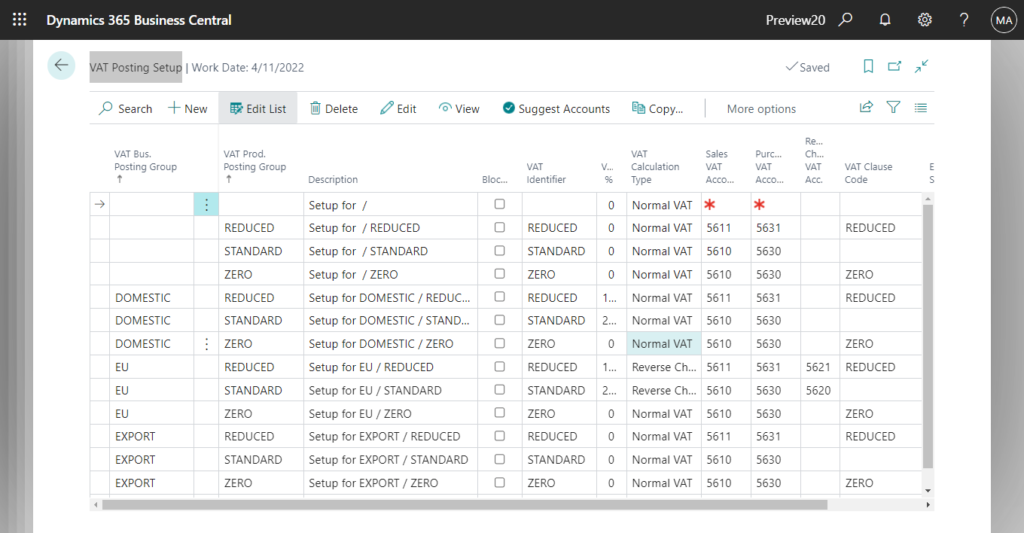

For example, VAT Posting Setup

And Business Central does not allow the deletion of VAT posting setup and General posting setup when there are entries created based on such configurations.

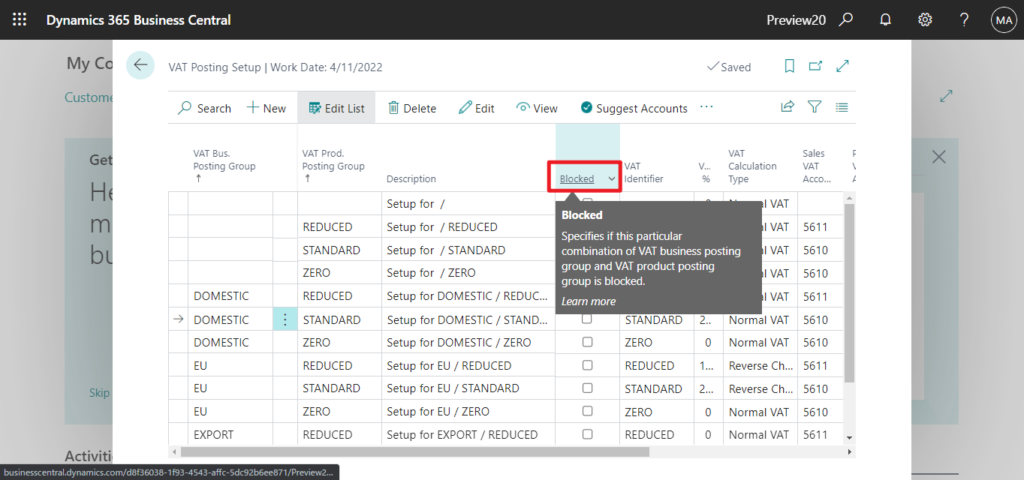

So when these setups are not used, they have to be left in the system. But now you can use the Blocked field in the VAT/Tax Posting Setup or General Posting Setup page to prevent users from mistakenly using old, no longer relevant setup for new postings.

Blocked field in VAT/Tax Posting Setup:

Blocked

Specifies if this particular combination of VAT business posting group and VAT product posting group is blocked.

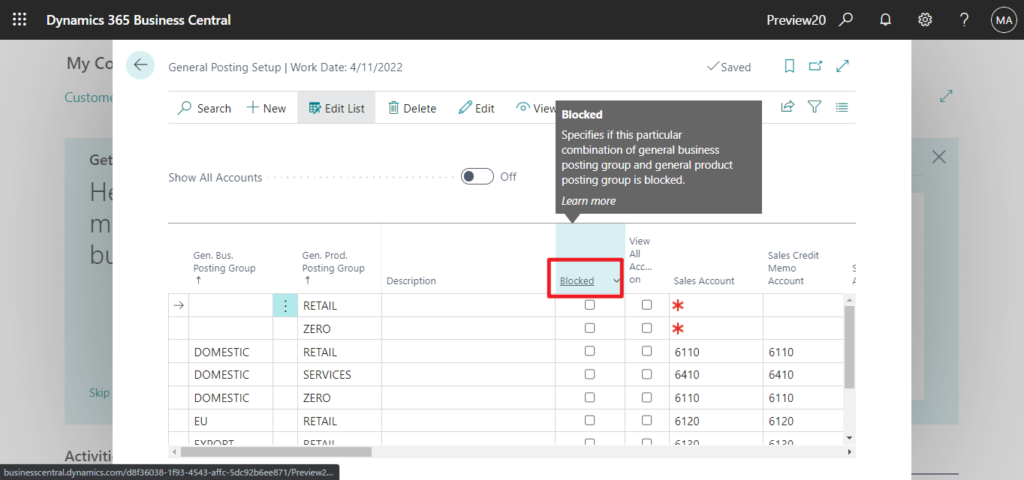

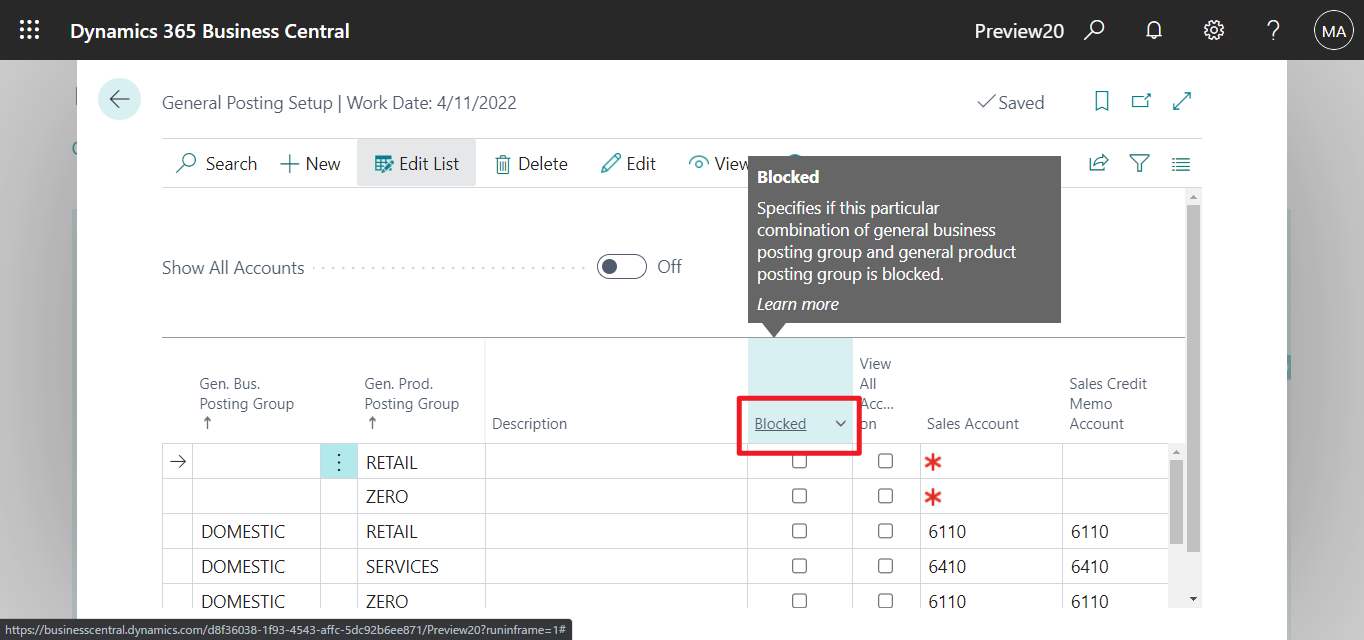

Blocked field in General Posting Setup:

Blocked

Specifies if this particular combination of general business posting group and general product posting group is blocked.

Let’s see more details.

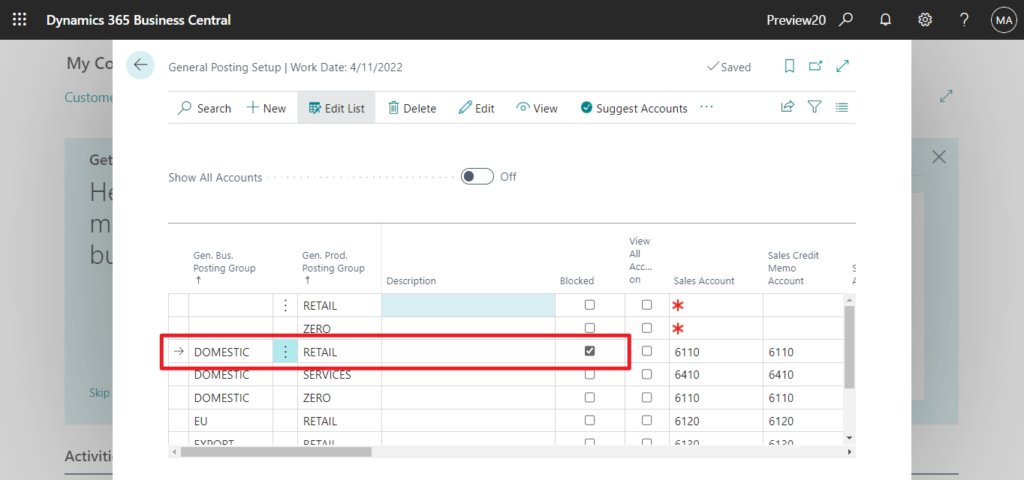

Block the combination of DOMESTIC and RETAIL in General Posting Setup.

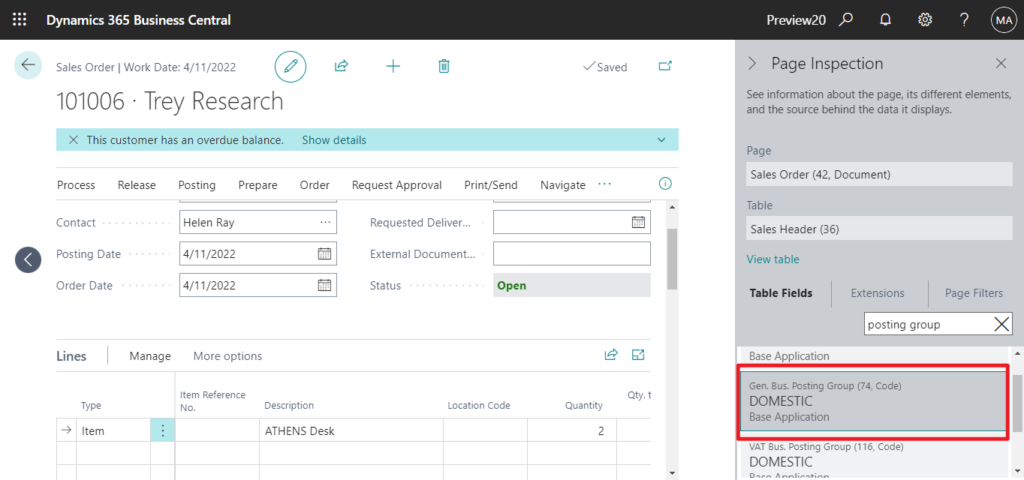

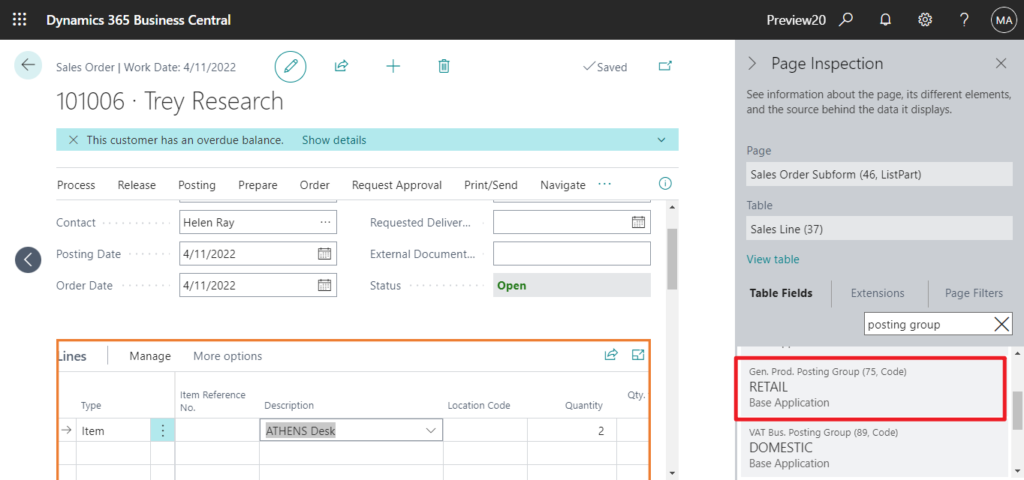

Create a new Sales Order with the combination of DOMESTIC and RETAIL, then post.

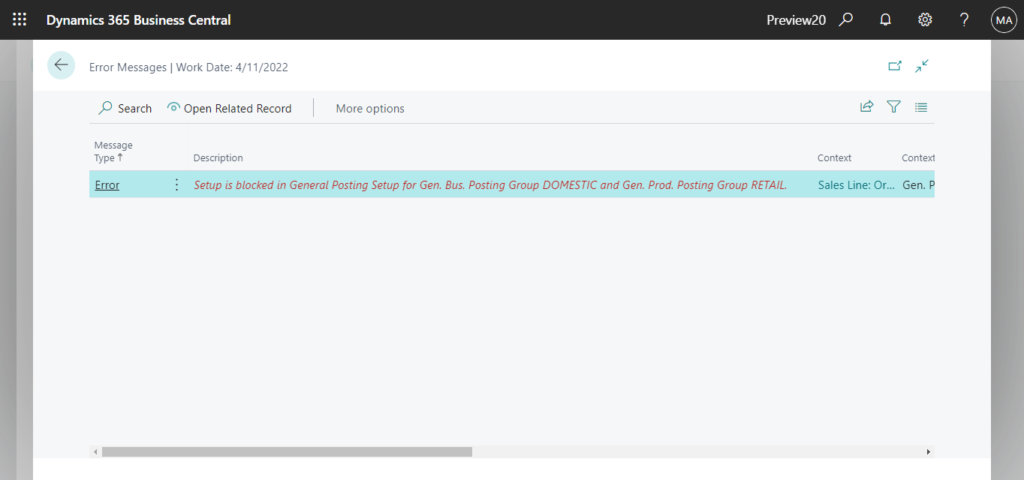

An new error message will be displayed when posting.

Setup is blocked in General Posting Setup for Gen. Bus. Posting Group DOMESTIC and Gen. Prod. Posting Group RETAIL.

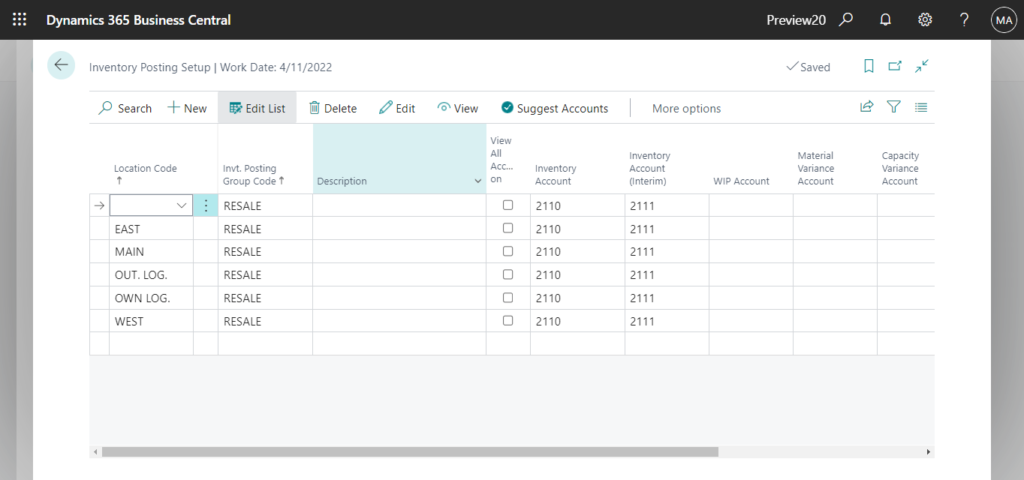

PS: As of now, Blocked field has only been added in VAT/Tax Posting Setup or General Posting Setup, not in other posting setups.

For example:

Inventory Posting Setup:

Update info from Dynamics 365 Business Central Launch Event 2022 Release Wave 1:

END

Hope this will help.

Thanks for reading.

ZHU

コメント